The Impact of Tax Increases on Smoking

Higher tobacco taxes have long been a popular tool in discouraging smoking. The logic is simple: make cigarettes more expensive, and fewer people will be willing to pay the higher price. While this approach has shown some success in reducing smoking rates, it has limitations.

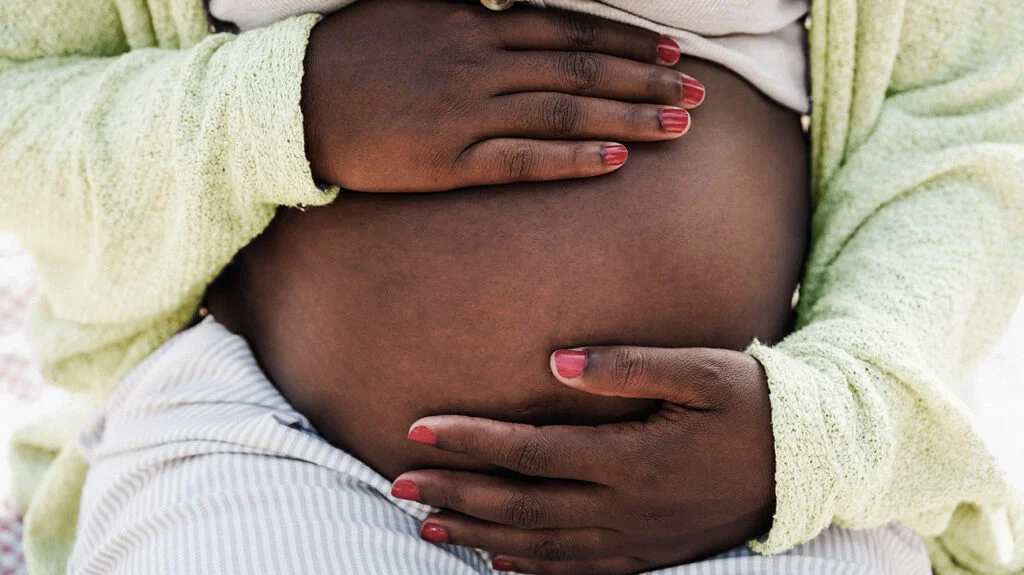

One of the major downsides of increasing tobacco taxes is that it predominantly affects lower-income individuals who are more likely to be smokers. It can lead to financial strain on those who are already economically disadvantaged. This regressive impact can undermine the intended health benefits of reducing smoking.

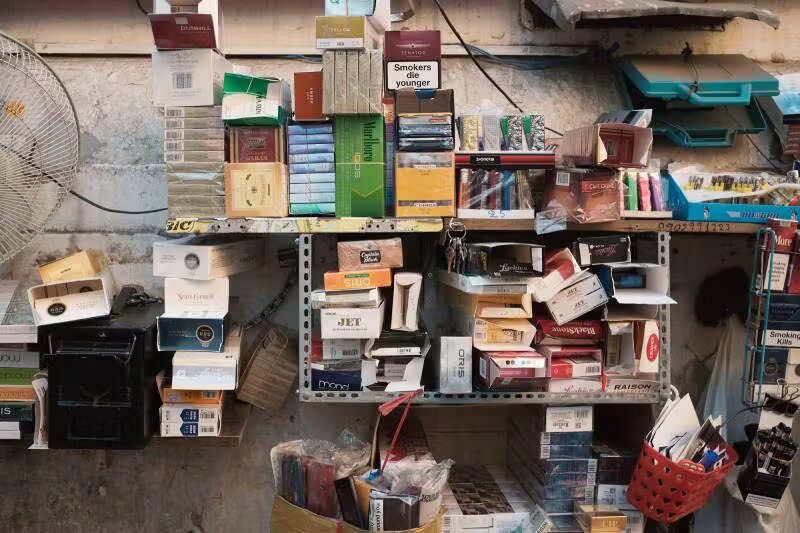

Moreover, the effectiveness of higher taxes as a deterrent varies. Some smokers may quit or reduce their consumption, while others may seek alternative, potentially riskier sources of nicotine. For many, quitting traditional cigarettes altogether can be a monumental challenge, even when the cost is a factor.

The Rise of Alternative Nicotine Products

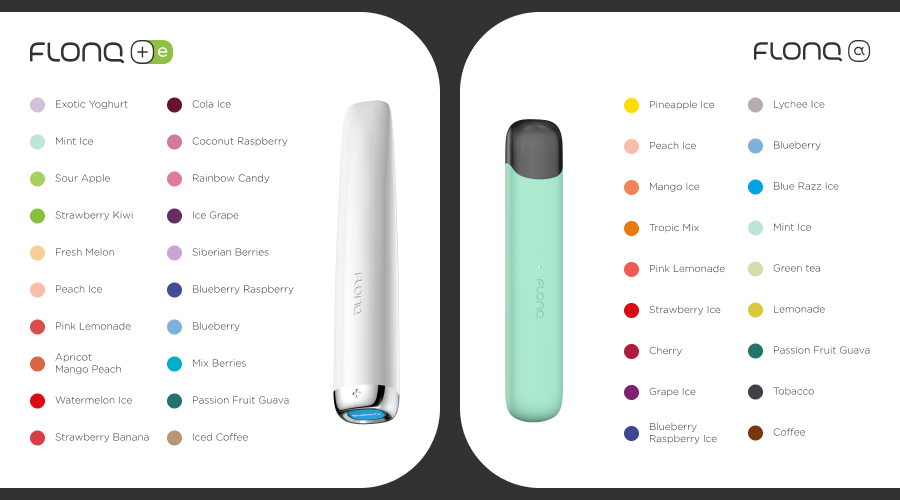

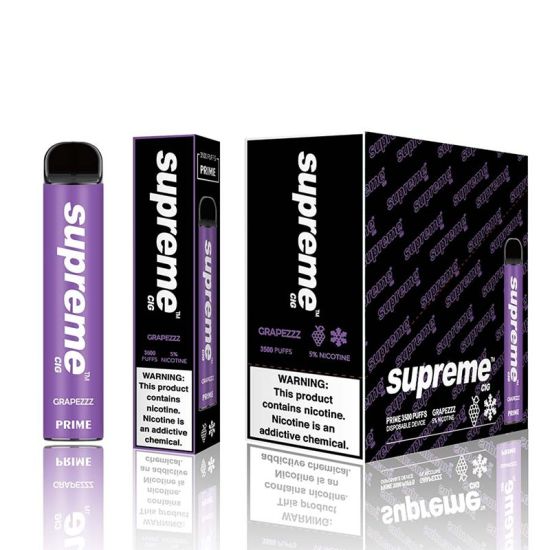

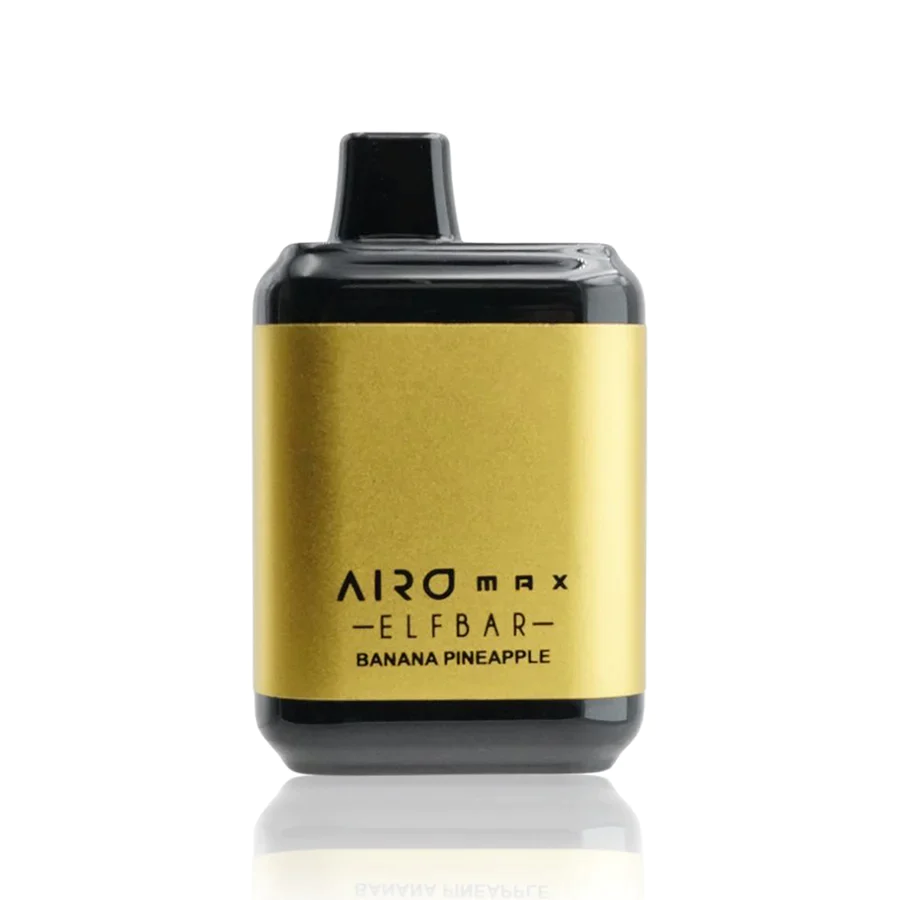

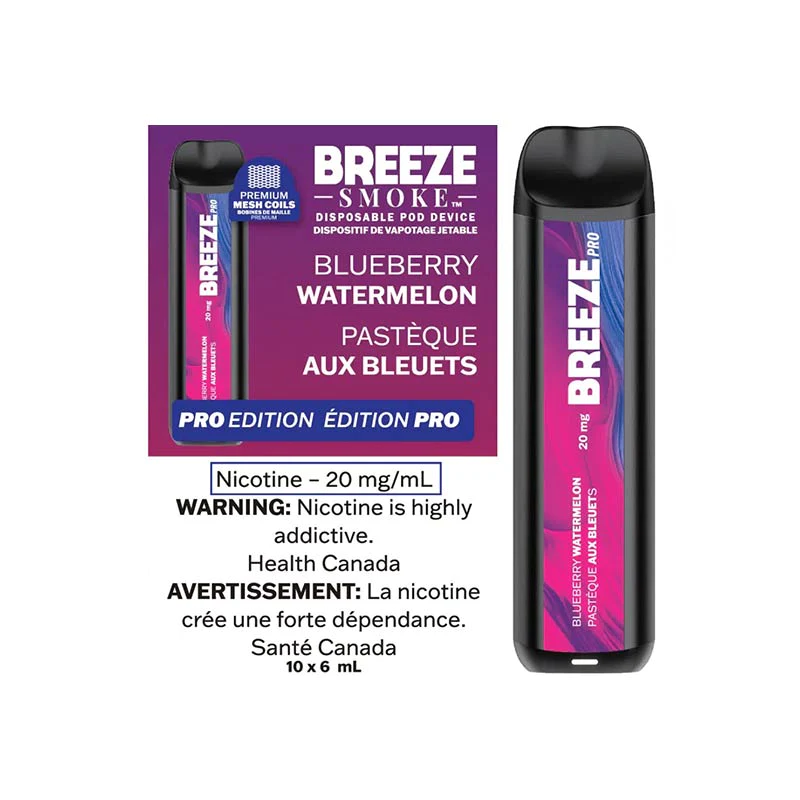

In recent years, alternative nicotine products such as e-cigarettes and vape devices, have gained popularity. These products provide a way for smokers to satisfy their nicotine cravings while reducing their exposure to harmful chemicals found in traditional cigarettes. The study in question highlights the effectiveness of these alternative products as a harm reduction strategy.

Alternative nicotine products offer several advantages:

- Reduced Harm: E-cigarettes and vape devices deliver nicotine without the combustion process, significantly reducing exposure to harmful tar and chemicals.

- Choice and Control: Smokers can gradually reduce their nicotine intake, giving them more control over their addiction and providing a pathway to quitting.

- Smoking Cessation Aid: Many individuals have successfully used e-cigarettes as a smoking cessation tool, making it easier to quit traditional smoking.

The Study’s Findings

The study, conducted by Research Institute Name, focused on the effectiveness of alternative nicotine products compared to increased tobacco taxes. It found that providing smokers with access to these products led to a significant reduction in traditional smoking rates. Smokers who used e-cigarettes or vape devices as an alternative to cigarettes were more likely to quit smoking or significantly reduce their consumption.

The study’s key findings include:

1. Smoking Reduction

Smokers who used alternative nicotine products were [X%] more likely to reduce their smoking habits.

2. Smoking Cessation

[X%] of participants who used e-cigarettes or vape devices successfully quit smoking within [X] months.

3. Harm Reduction

Participants who switched to alternative nicotine products experienced a noticeable decrease in exposure to harmful chemicals.

Conclusion

While increasing tobacco taxes remains a well-intentioned strategy to reduce smoking rates, the study’s findings suggest that providing smokers with alternative nicotine products offers a more effective path to harm reduction and smoking cessation. These products provide a viable alternative that enables smokers to regain control over their addiction without the financial strain of higher taxes.

It’s important for governments and health organizations to consider these findings and explore policies that support the availability and regulation of alternative nicotine products. By doing so, we can empower individuals to make healthier choices and reduce the burden of smoking-related illnesses on society as a whole. The study proves that there is a more effective way to combat smoking, and it’s time to embrace it.

0