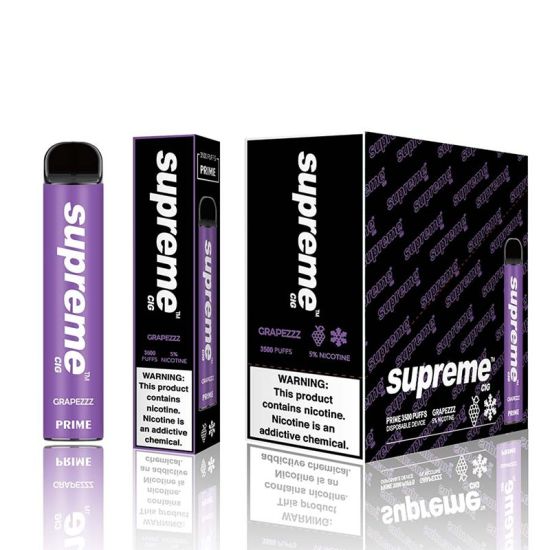

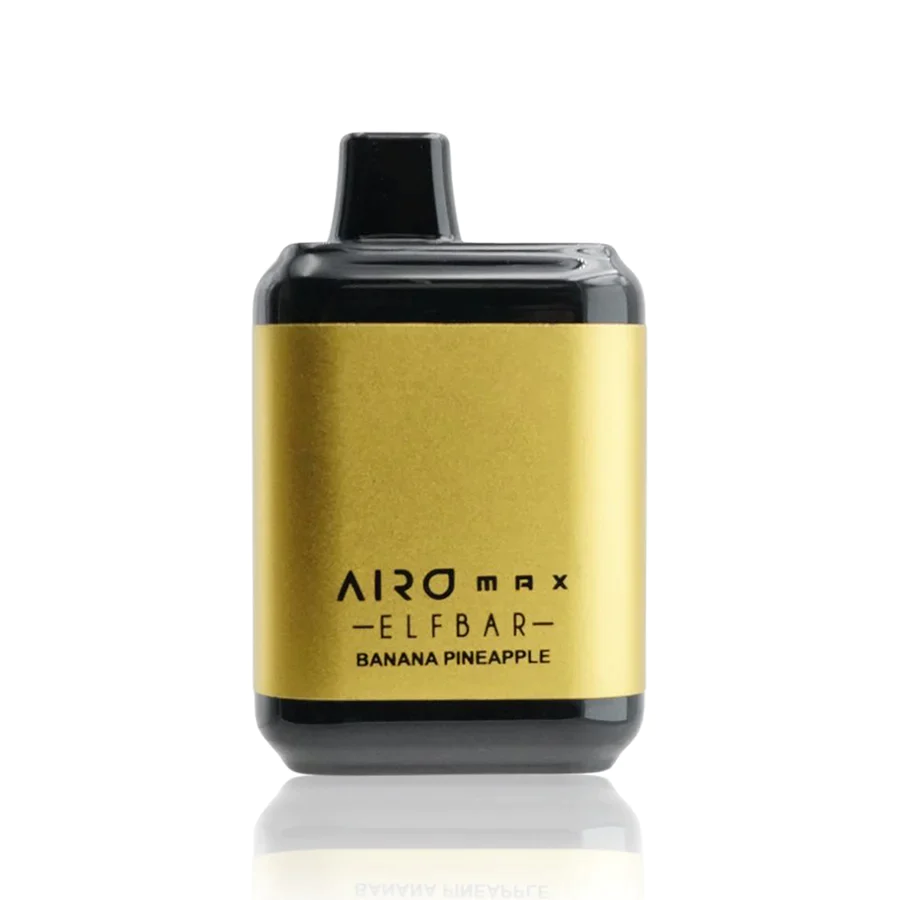

Understanding the Implications of the Proposed Vape Tax in the UK

In recent news, the United Kingdom has unveiled its intention to implement a significant increase in taxes on vaping products. This move marks a pivotal moment in the regulation of vaping within the country and is expected to have far-reaching effects on both consumers and the industry as a whole.

The Rationale Behind the Proposed Vape Tax

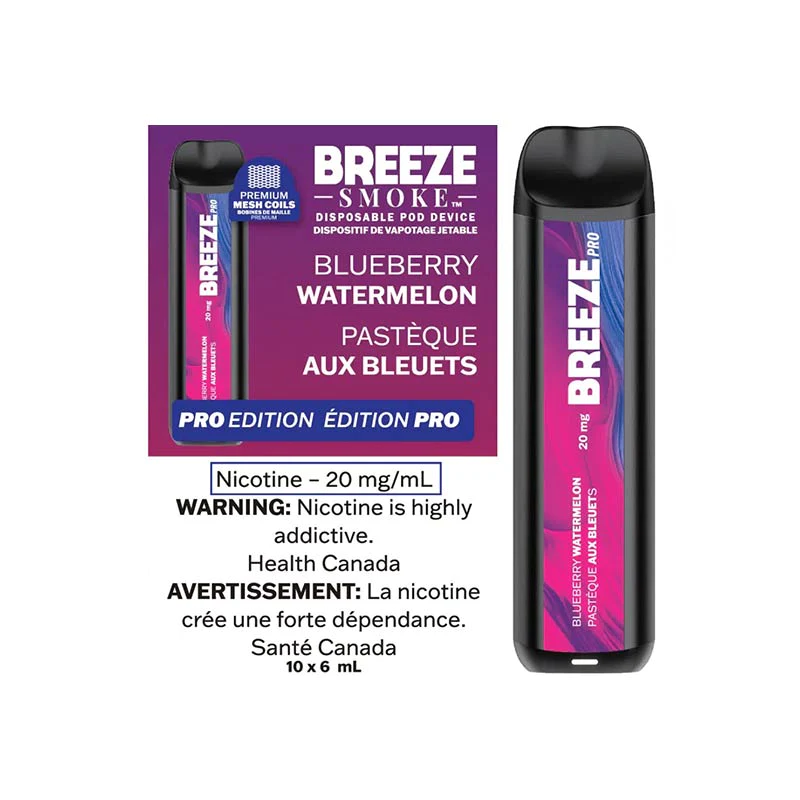

The UK government’s decision to introduce a steep new vape tax is primarily driven by concerns surrounding public health and the rising prevalence of vaping among young people. Authorities argue that imposing higher taxes on vaping products will help deter younger individuals from taking up the habit, ultimately reducing the risk of nicotine addiction and associated health issues.

Potential Impact on Consumers

For consumers, the proposed vape tax is likely to result in a noticeable increase in the cost of vaping products. This price hike could deter some individuals from purchasing vaping devices and e-liquids, particularly those who rely on vaping as an alternative to traditional tobacco smoking. Additionally, higher prices may prompt existing vapers to seek out cheaper alternatives or explore other cessation methods, such as nicotine replacement therapies.

Economic Implications for the Vaping Industry

The introduction of a steep vape tax poses significant challenges for businesses operating within the vaping industry. Manufacturers, retailers, and distributors are bracing themselves for a potential decline in sales as consumers adjust to the higher prices. Moreover, smaller companies may struggle to absorb the increased costs associated with compliance and taxation, leading to market consolidation and potential job losses within the sector.

Regulatory Considerations and Enforcement

As the UK government moves forward with its plans to implement the new vape tax, regulatory agencies will play a crucial role in ensuring compliance and enforcement. Measures such as age verification requirements and restrictions on advertising may be strengthened to prevent underage access to vaping products and mitigate the influence of marketing tactics targeting youth audiences.

The Road Ahead

While the announcement of a steep new vape tax has sparked debate and controversy within the vaping community, its full impact remains to be seen. As stakeholders adapt to the changing regulatory landscape, policymakers will closely monitor the effectiveness of the tax in achieving its intended objectives. Ultimately, the success of this initiative will hinge on striking a balance between public health objectives and the interests of consumers and businesses alike.

0