The Implications for Vapers and the Vaping Industry

Introduction

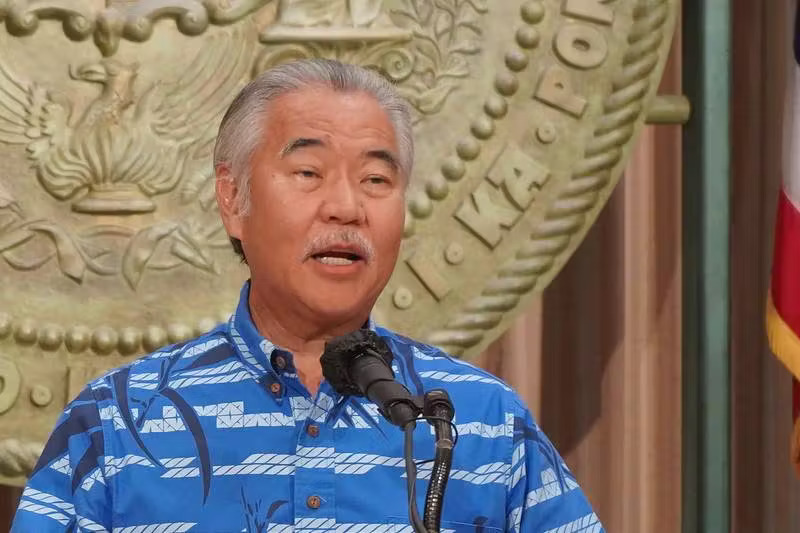

The vaping landscape in Hawaii is set to undergo a major change with the recent passing of a bill that imposes a hefty

70% tax on vape products. The new legislation has sparked debates and concerns among vapers and industry

professionals alike. In this article, we will explore the implications of this tax and its potential impact on the

vaping community.

The Details of the Vape Tax

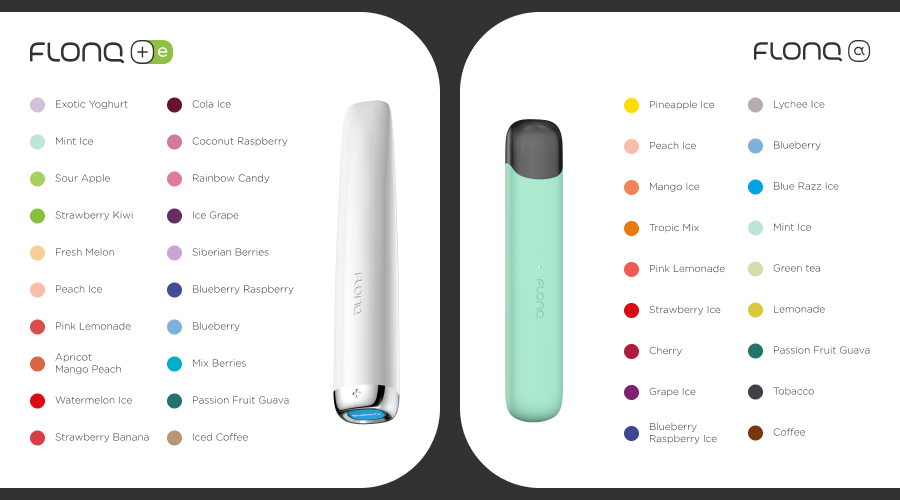

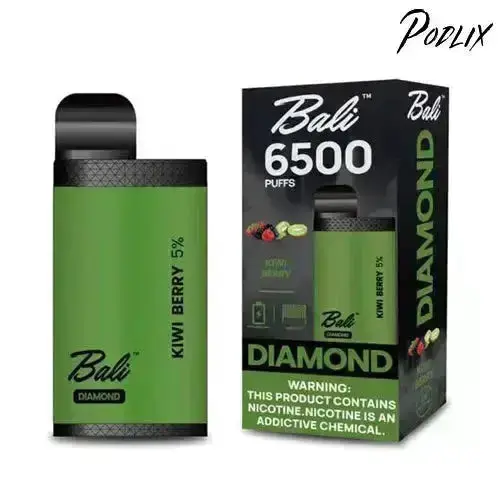

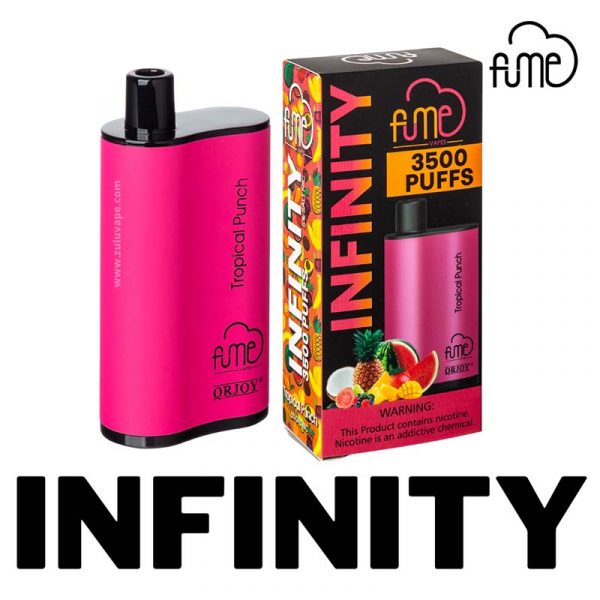

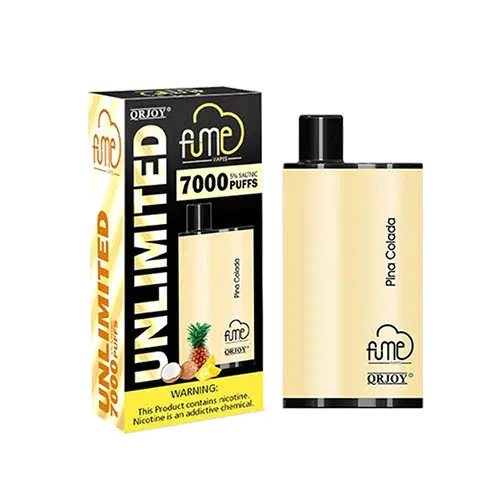

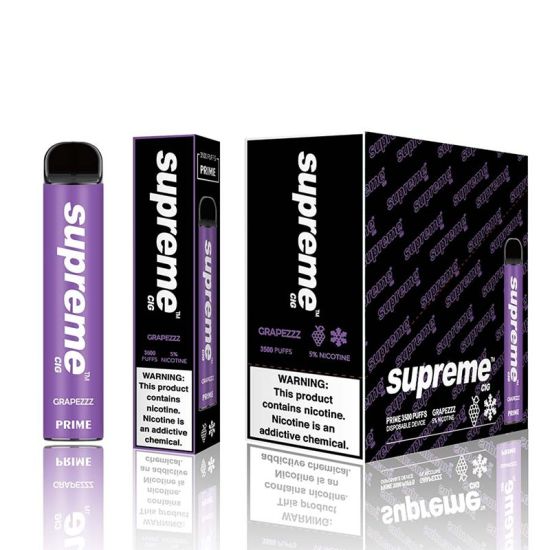

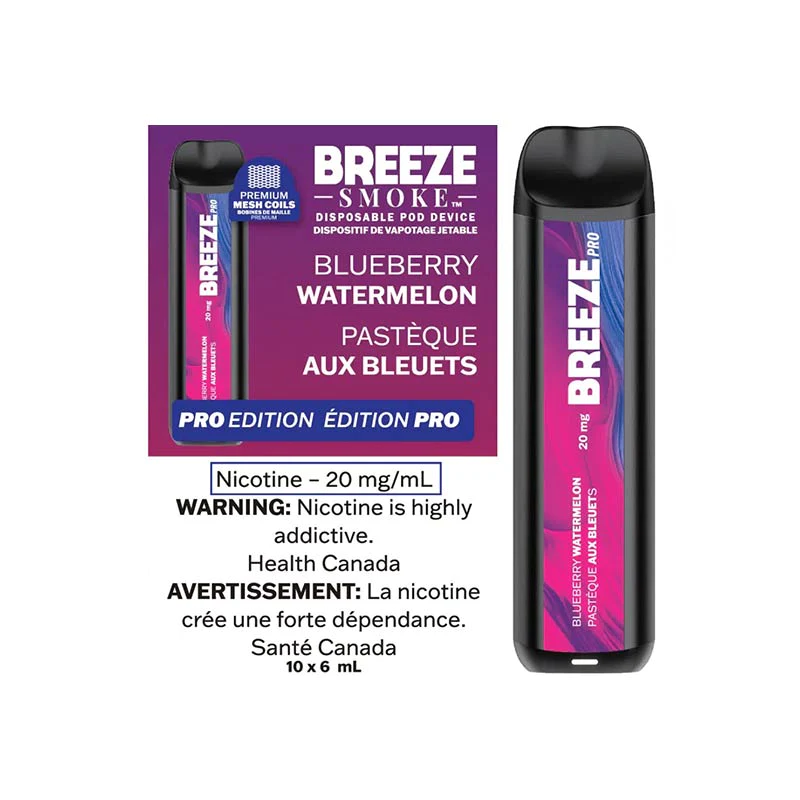

The newly passed bill introduces a 70% tax on all vape products sold in Hawaii. This includes e-cigarettes,

e-liquids, and other vaping devices. The tax aims to deter vaping among young people and generate revenue for public

health programs. However, critics argue that such a high tax rate will have unintended consequences.

Impact on Vapers

For vapers in Hawaii, the 70% tax means a significant increase in the cost of vaping. Many vapers rely on e-cigarettes

as an alternative to traditional smoking, and the tax could make vaping less accessible and affordable for those

trying to quit smoking. Additionally, vapers who use e-liquids or other vaping products may have to adjust their

budgets to accommodate the increased costs.

Effects on the Vaping Industry

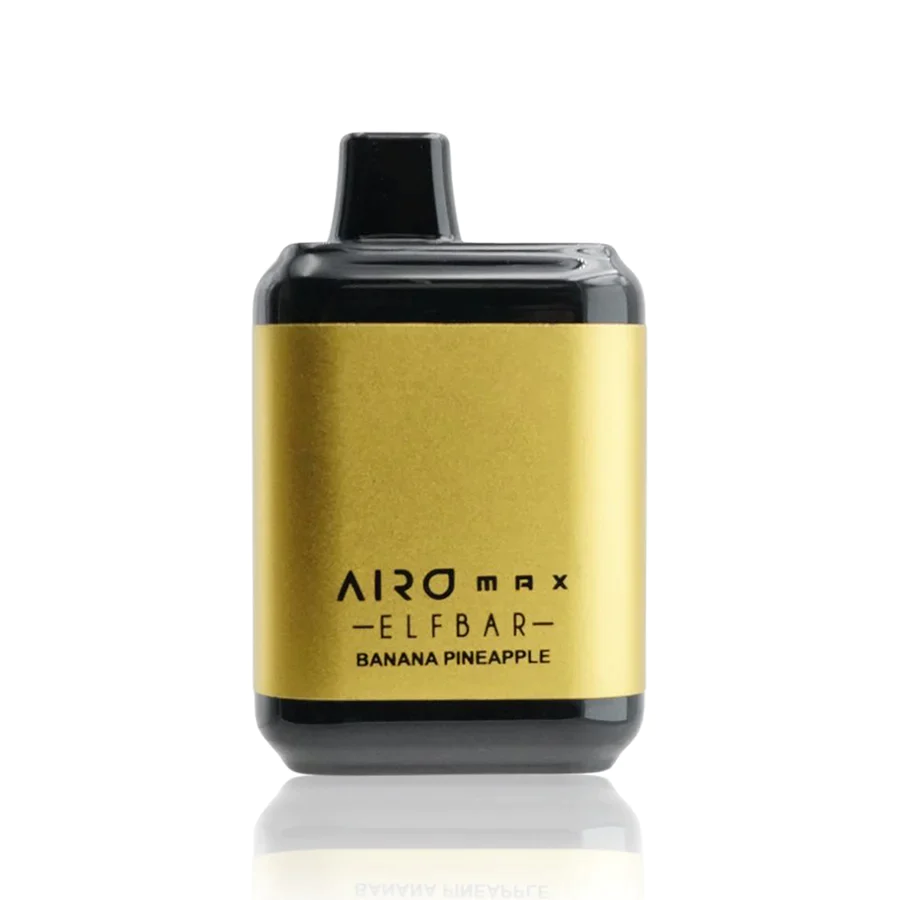

The vape tax also raises concerns within the vaping industry. Small vape businesses may struggle to absorb the higher

costs and may be forced to pass them onto consumers or even shut down. This could lead to a loss of jobs and a

decline in product variety and availability. Furthermore, the tax may create a barrier for new vapers looking to

enter the market.

Conclusion

The passing of the 70% vape tax in Hawaii has significant implications for vapers and the vaping industry. While the

intention behind the tax is to address public health concerns, it raises questions about access, affordability, and

the future of vaping in the state. As the new tax takes effect, it remains to be seen how it will impact vapers and

whether it will achieve its desired outcomes.

0