Introduction

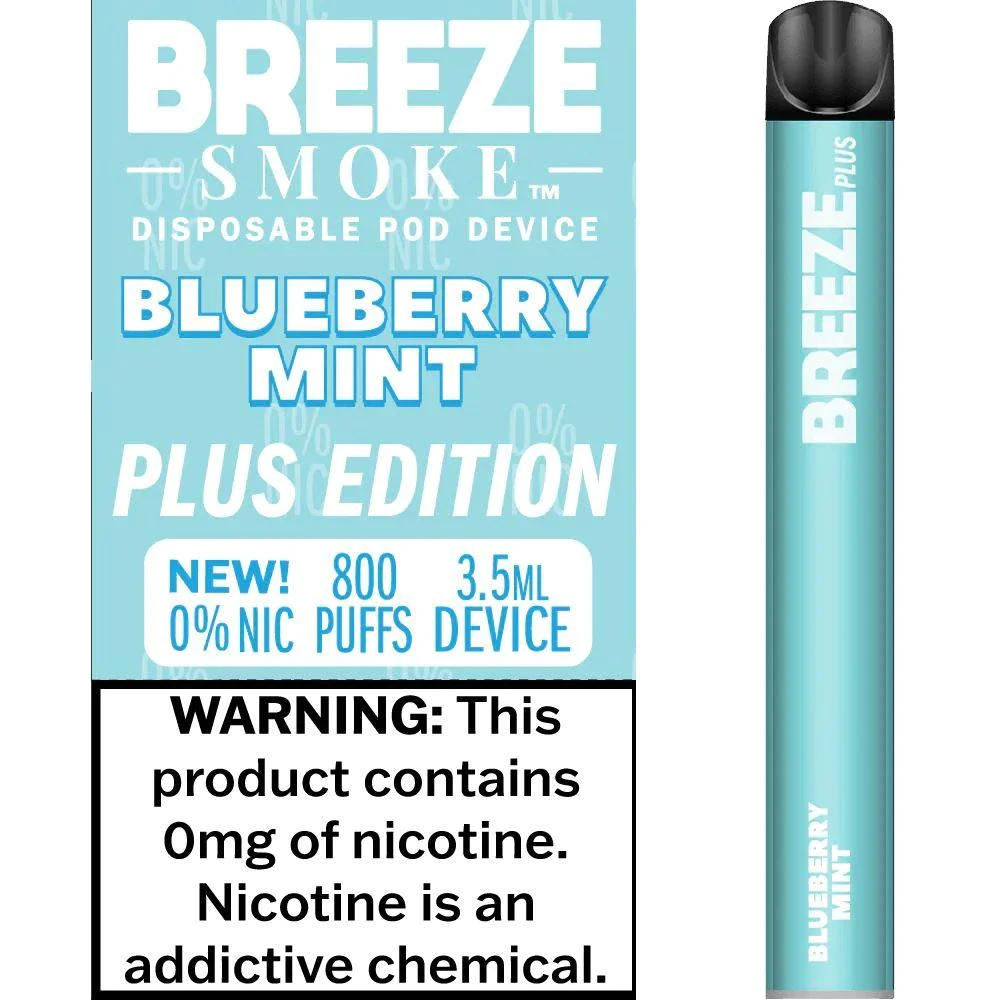

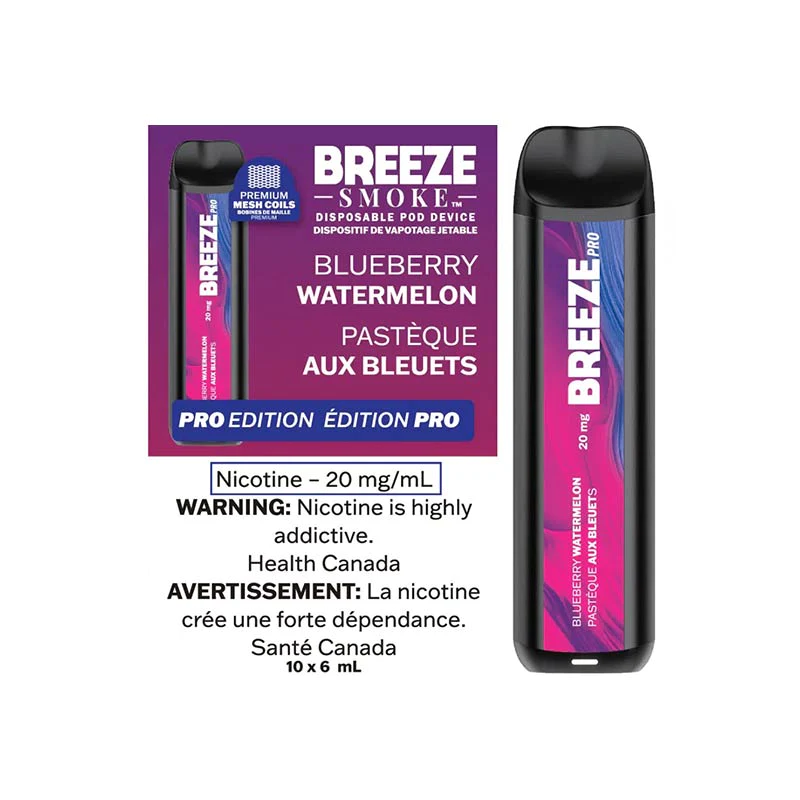

In recent legislative developments, a new tax equity bill has emerged, aiming to reshape the financial landscape of vaping. If passed, this bill would substantially increase taxes on vaping products, potentially making them more expensive than traditional cigarettes. This proposed shift in taxation policy has raised concerns and ignited debates within the vaping community and the public at large.

Understanding the Proposed Tax Equity Bill

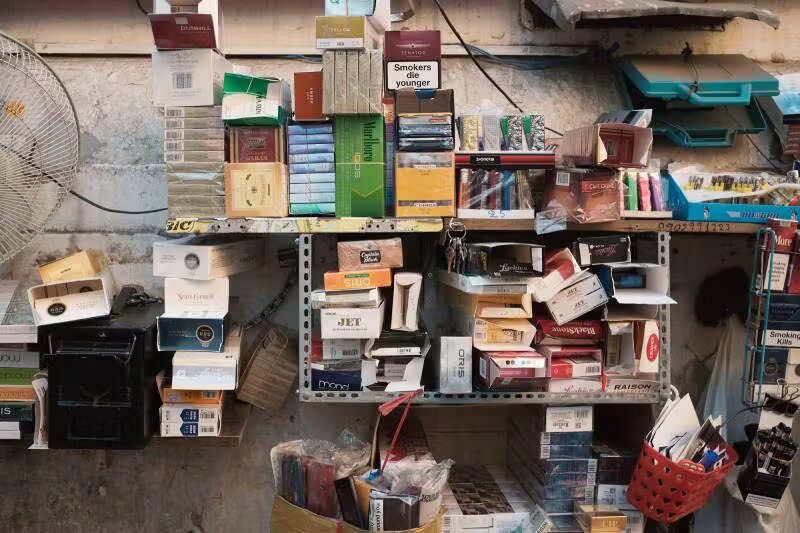

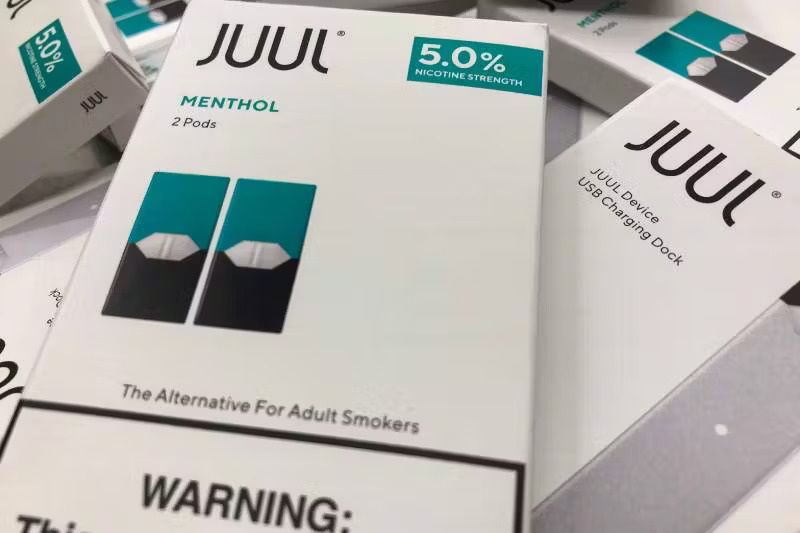

The new tax equity bill proposes a significant increase in taxes on vaping products, equating them to or even surpassing the taxes imposed on traditional tobacco products. The objective is to bridge the tax disparity between vaping and smoking, ostensibly for reasons of public health and economic balance.

Potential Impact on Vaping Costs

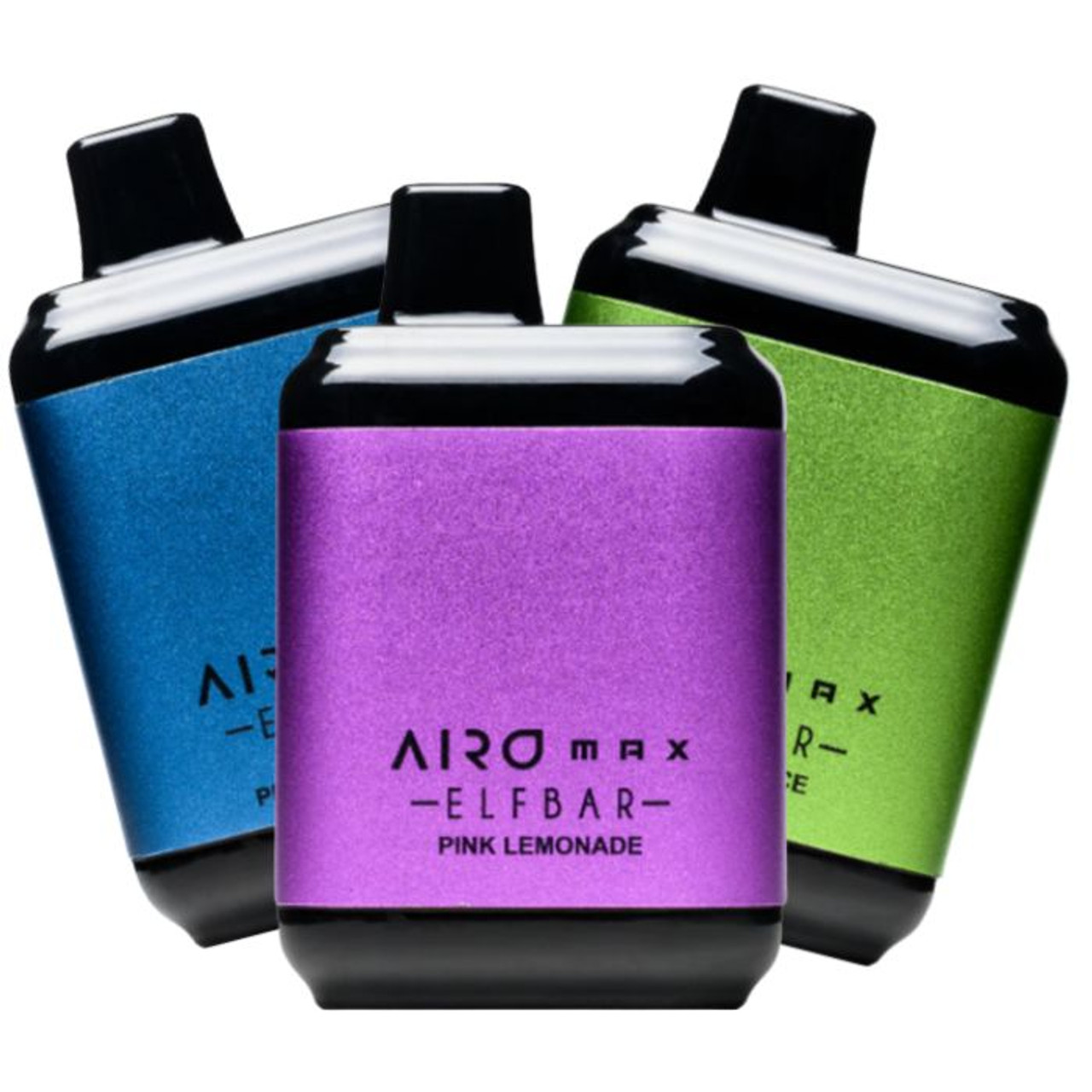

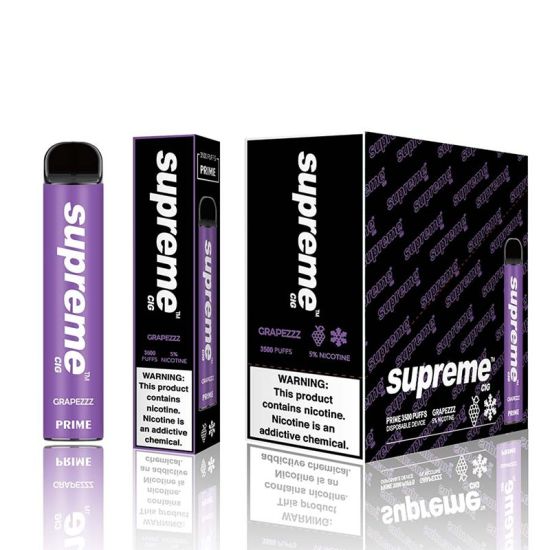

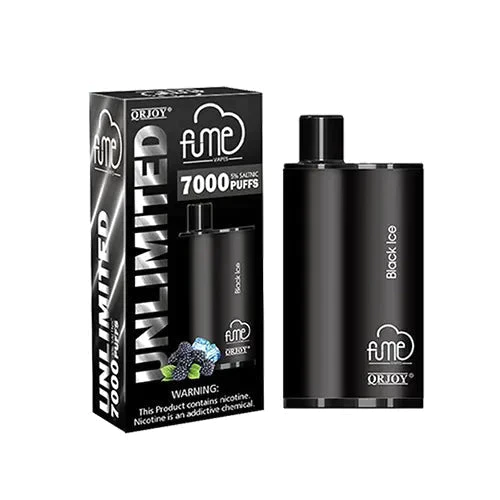

Increased Prices for Vaping Products

Should this bill become law, consumers can expect a notable surge in the prices of vaping products. This financial burden may discourage existing vapers and potentially deter smokers from transitioning to vaping as a harm reduction alternative.

Economic Implications

The potential increase in prices could lead to a reduction in sales of vaping products, impacting businesses within the vaping industry. Additionally, this might hinder the growth of small-scale businesses and startups, ultimately affecting the economic landscape.

Critiques and Concerns

Equity and Fairness

Critics argue that equating the taxes on vaping products with traditional cigarettes is unfair. Vaping is often viewed as a less harmful alternative to smoking and is utilized by many as a smoking cessation tool. Imposing comparable taxes on vaping products could discourage smokers from making the switch to a potentially less harmful option.

Impact on Public Health

Advocates for harm reduction believe that increasing the cost of vaping could have adverse effects on public health. For individuals using vaping as a smoking cessation tool, higher costs might deter them from attempting to quit or push them back towards traditional smoking.

Conclusion

The proposed tax equity bill has sparked a significant discussion concerning the future of vaping in relation to traditional smoking. Striking a balance between taxation policies that discourage vaping among the youth and maintaining it as a harm reduction tool for current smokers remains a complex challenge. It’s important for lawmakers to carefully consider the potential consequences of such legislation on public health, the economy, and individual choices.

0