In a pivotal move that could have far-reaching implications for the vaping industry, Germany has recently passed legislation to introduce an E-Liquid Tax. This decision comes at a crucial time, with the European Union (EU) also considering potential regulations on vaping products. In this blog post, we delve into the details of Germany’s E-Liquid Tax and the broader context of the impending EU decision.

The German E-Liquid Tax: Understanding the Basics

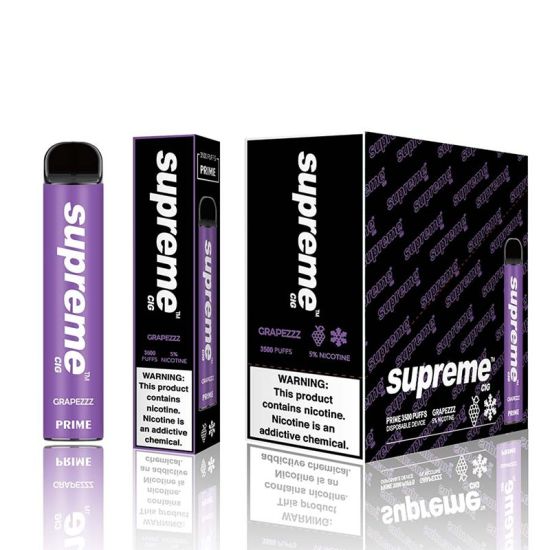

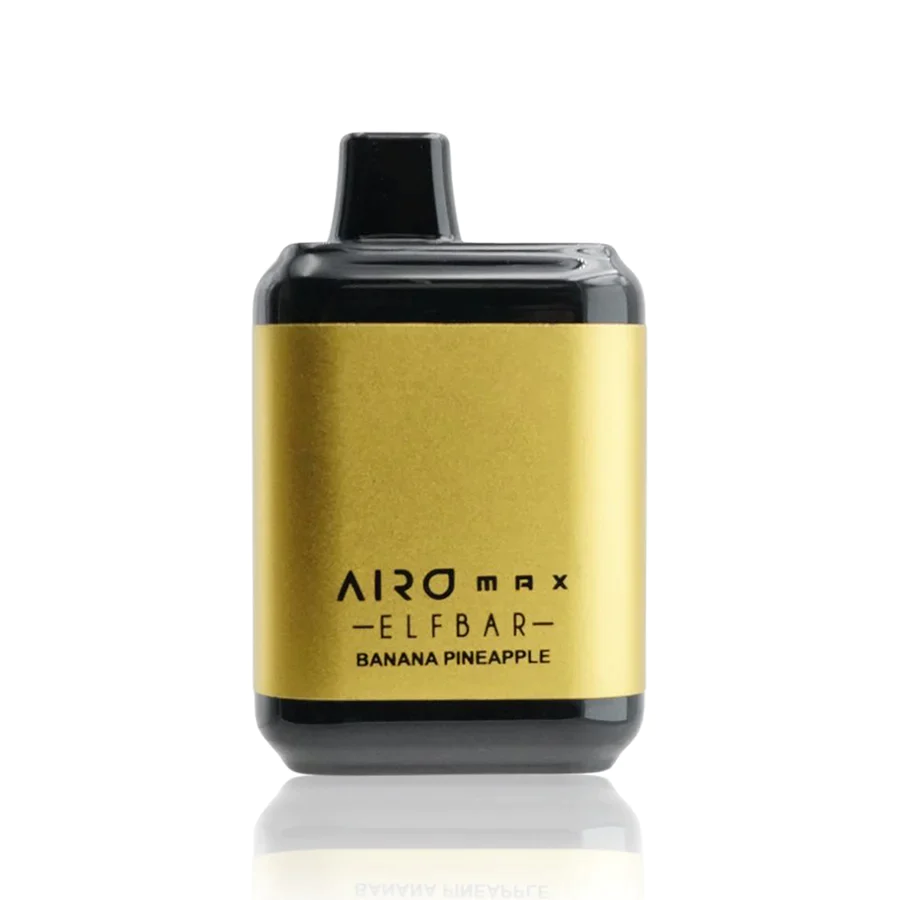

The newly passed E-Liquid Tax in Germany signifies a significant development in the country’s approach to regulating vaping products. The tax is expected to be applied to e-liquids containing nicotine, with the aim of generating revenue and potentially curbing the use of vaping among certain demographics. The specifics of the tax structure, including rates and implementation, will be crucial factors influencing both consumers and industry stakeholders.

Implications for Vapers and Industry Players

As Germany takes this step towards regulating e-liquids, vapers and industry players are left to assess the implications. For vapers, the E-Liquid Tax may result in increased costs for their preferred products. Additionally, the tax could prompt changes in purchasing behavior and preferences. Industry players, on the other hand, will need to navigate the regulatory landscape and potentially adjust business models to comply with the new tax regulations.

The Broader Context: EU Contemplates Vaping Regulations

Germany the backdrop of the EU contemplating regulations on vaping products. The EU has been reviewing potential measures to standardize vaping rules across member states. This includes considerations for product safety, packaging, advertising, and potential taxation. The outcome of these deliberations will not only impact Germany but could set a precedent for vaping regulations across the entire EU.

Industry Responses and Advocacy

As governments, including Germany, and the EU deliberate on vaping regulations, the industry is responding with advocacy efforts. Various stakeholders, including vaping associations and advocacy groups, are engaging with policymakers to ensure that regulations are fair, balanced, and based on scientific evidence. The industry’s response and advocacy play a crucial role in shaping the future of vaping regulations in Germany and the broader EU.

Conclusion: Navigating Changes in the Vaping Landscape

In conclusion, the passage of the E-Liquid Tax in Germany and the ongoing EU deliberations signal a period of change in the vaping landscape. Vapers, industry players, and advocacy groups are closely monitoring developments to understand the impact of these regulatory decisions. The path forward involves navigating changes, advocating for sensible regulations, and adapting to a vaping landscape that is evolving in response to government decisions.

0