Evaluating the Economic Impact

A Balancing Act for Public Health

Public Health Priorities: Georgia’s consideration to increase taxes on cigarettes and vape products stems from a dual commitment: promoting public health and generating revenue for essential services. Higher taxes on tobacco and vape items are often seen as a deterrent, aimed at reducing consumption and subsequently lowering the prevalence of smoking and vaping.

The Cigarette Conundrum: Cigarette smoking remains a significant public health concern, with associated risks ranging from respiratory diseases to cardiovascular issues. By increasing taxes on cigarettes, Georgia aims to discourage smoking, especially among the younger population, and allocate resources to anti-smoking campaigns and healthcare initiatives.

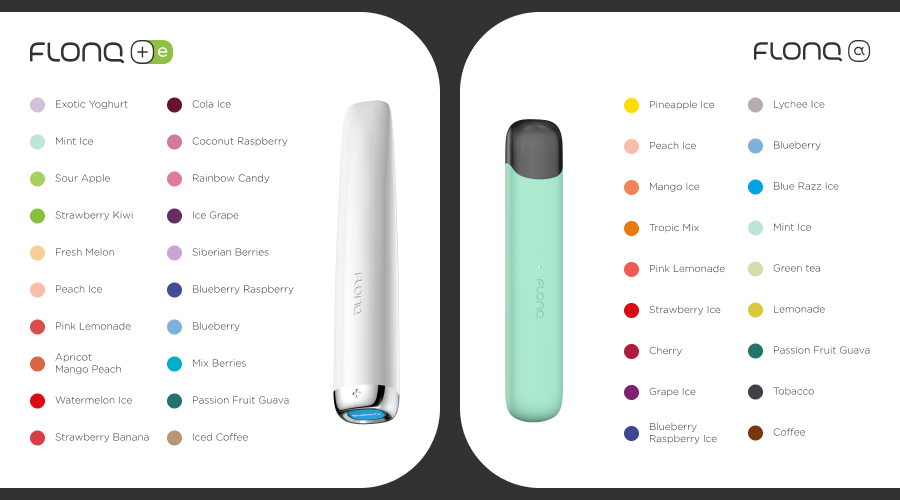

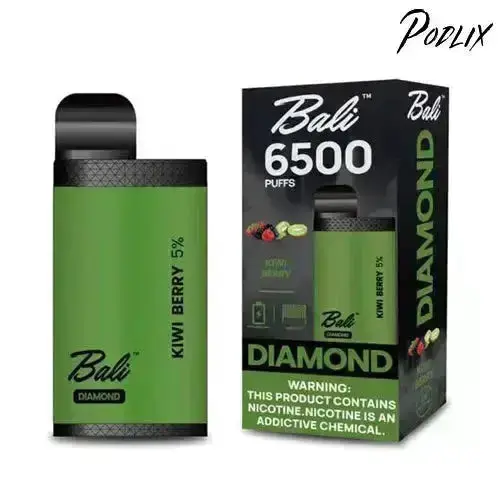

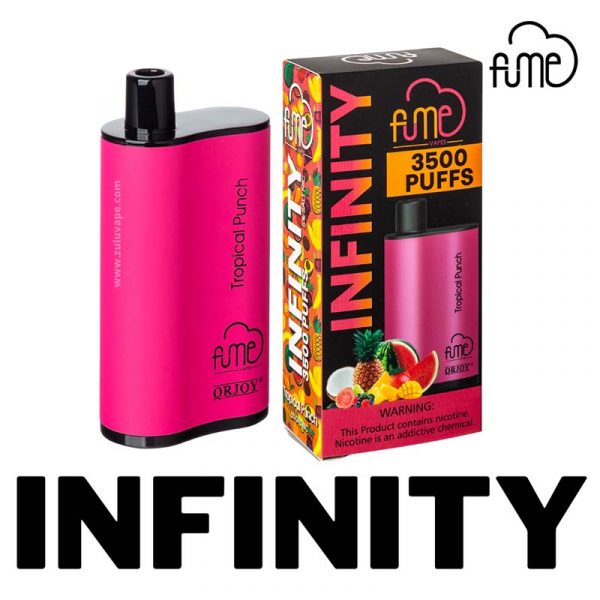

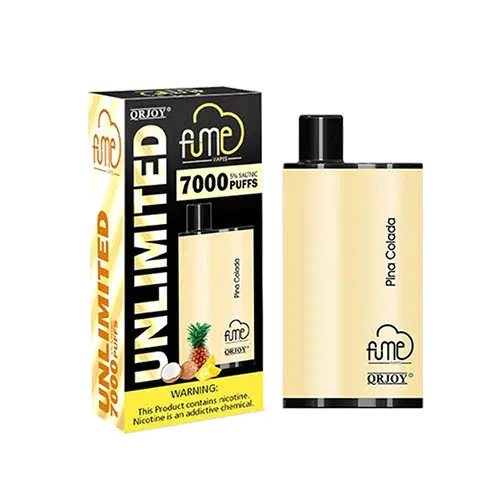

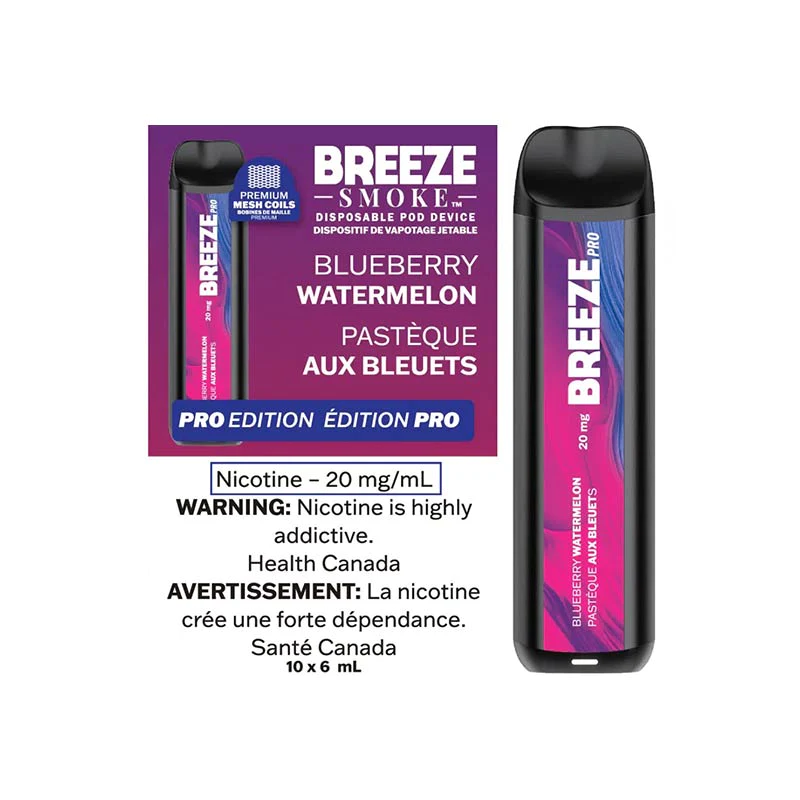

Vaping in the Equation: The rise of vaping presents a unique challenge and opportunity. While considered by some as a less harmful alternative to traditional smoking, concerns about the health impacts of vaping persist. Georgia’s contemplation of higher taxes on vape products reflects the need to address both the public health implications and the potential for increased revenue.

Economic Ramifications

Impact on Consumer Behavior: One immediate effect of increased cigarette and vape taxes is the potential shift in consumer behavior. Higher prices often lead to decreased consumption, contributing to a decline in smoking and vaping rates. This shift aligns with the state’s public health objectives but requires a delicate balance to prevent unintended consequences.

Revenue Generation for Public Services: On the economic front, the additional tax revenue could become a crucial resource for funding public services such as education, healthcare, and infrastructure. The state faces the challenge of striking a balance between discouraging harmful habits and ensuring a sustainable source of income for essential programs.

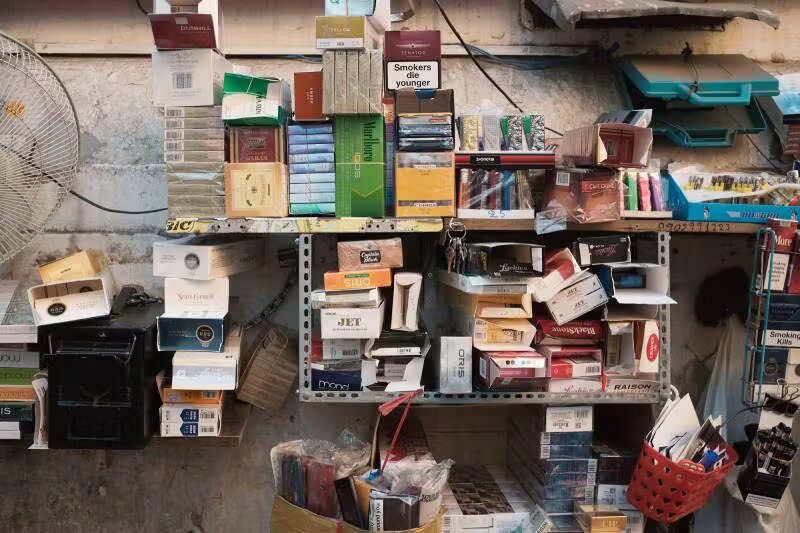

Consideration for Small Businesses: Georgia must also consider the impact on local businesses, particularly small retailers that heavily rely on the sale of tobacco and vape products. Striking a balance that addresses public health concerns without unduly burdening local businesses is a delicate task for policymakers.

Conclusion: A Decision with Far-reaching Effects

As Georgia contemplates increasing cigarette and vape taxes, the state stands at a pivotal juncture. The decision will not only shape public health outcomes but also influence the economic landscape. Striking a balance between discouraging harmful habits, generating revenue, and supporting local businesses will require careful consideration and a comprehensive approach. The coming months will reveal the path Georgia chooses to take and the subsequent impact on the health and prosperity of its residents.

0