A New Chapter in Maryland’s Vaping Regulations

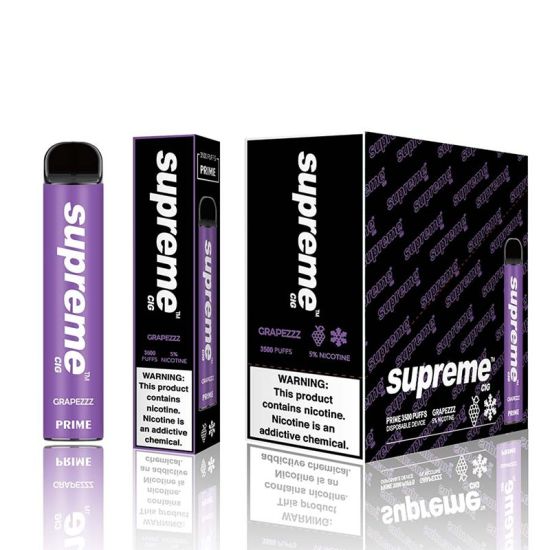

Maryland has entered a new phase in its approach to vaping with the recent passing of a vape tax, marking a significant development in the state’s regulation of electronic nicotine delivery systems (ENDS). However, amidst this financial imposition, the battle over flavored vape products rages on.

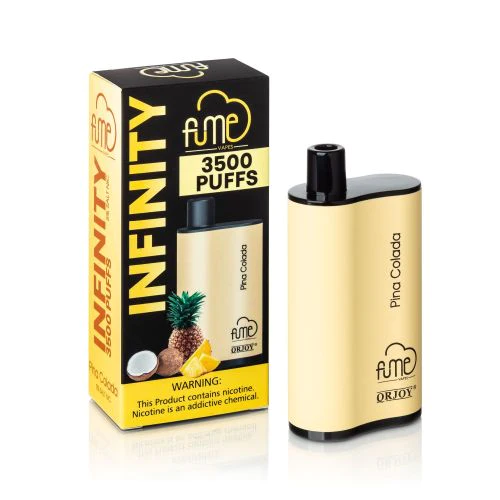

Understanding the Vape Tax Legislation

Maryland’s decision to implement a vape tax underscores the state’s commitment to addressing public health concerns related to vaping. The legislation aims to not only generate revenue but also to discourage vaping, particularly among youth. Vape retailers and consumers alike are now grappling with the implications of this tax and its potential impact on the vaping landscape.

Navigating the Impact on Vape Retailers

Compliance Challenges for Vape Businesses

Vape retailers in Maryland are now faced with a series of compliance challenges brought about by the new tax regulations. These challenges include understanding tax calculation methods, ensuring accurate record-keeping, and implementing necessary changes in pricing structures. Navigating these complexities is crucial for businesses to remain operational and compliant.

Tax Calculation and Collection

The implementation of a vape tax requires retailers to accurately calculate and collect taxes on their products. Understanding the specifics of the tax structure, including which products are taxable and at what rate, becomes essential. Vape businesses must adapt their systems to incorporate these changes seamlessly.

The Ongoing Battle: Flavored Vapes and Public Health

Maryland’s Stance on Flavored Vapes

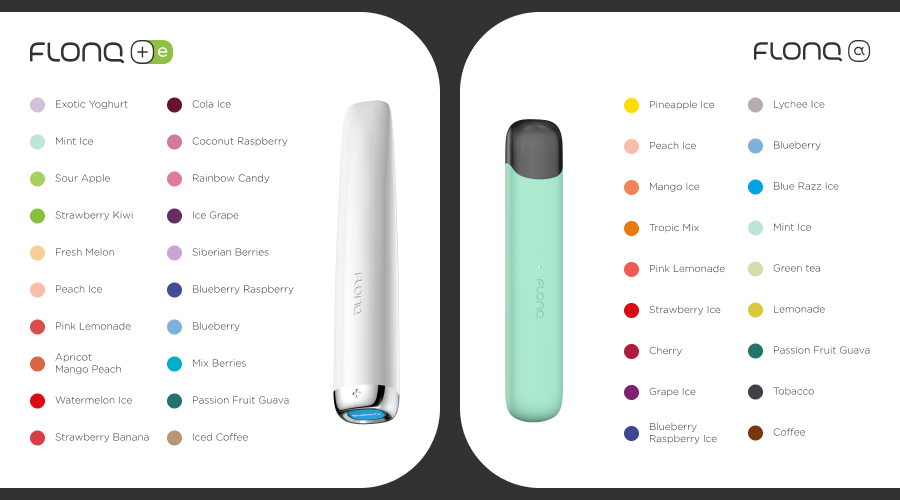

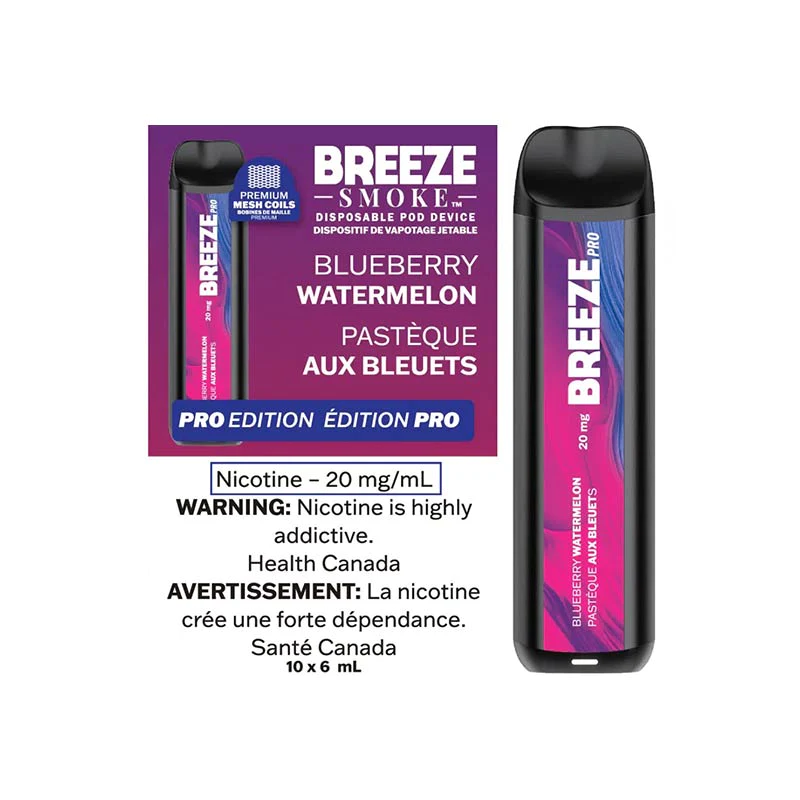

While the vape tax has taken center stage, the fight over flavored vape products continues to be a contentious issue in Maryland. Advocates argue that flavored vapes attract youth, while opponents claim that flavors play a vital role in helping adult smokers transition away from traditional tobacco products.

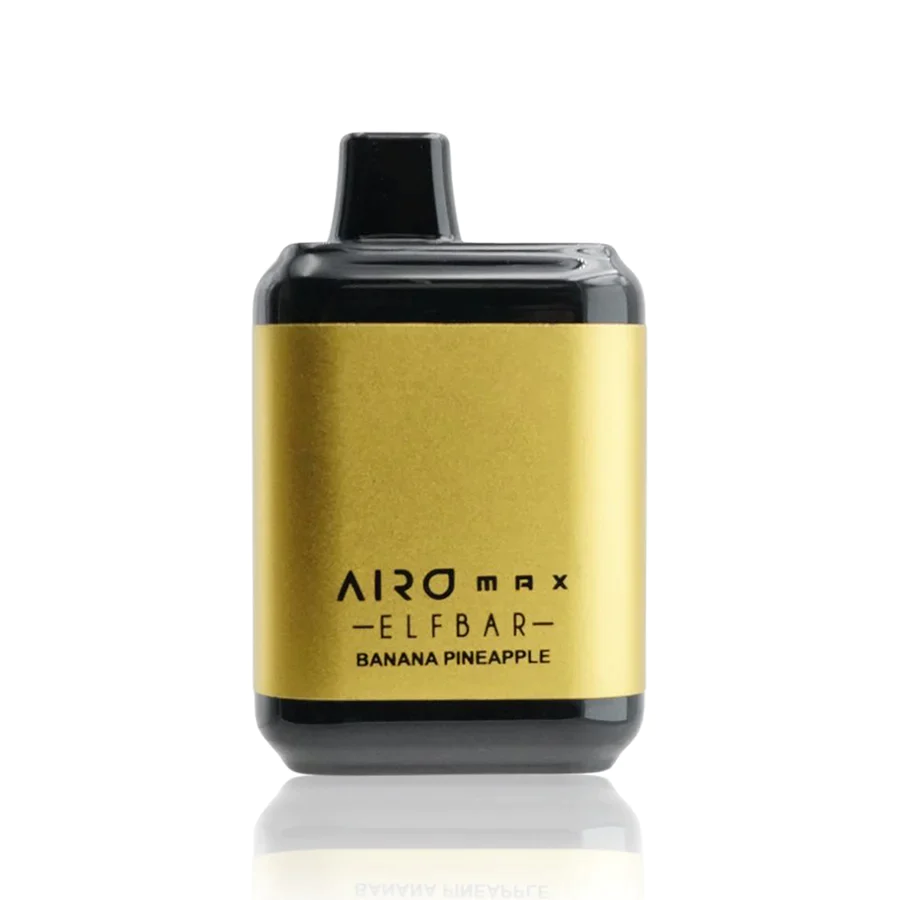

Impact on Consumer Choice

The debate over flavored vapes extends beyond legislative chambers to impact consumer choices. Maryland vapers are now faced with the prospect of limited flavor options or the potential unavailability of their favorite products. The delicate balance between addressing public health concerns and preserving consumer choice remains a central theme in this ongoing discourse.

Advocacy and the Future of Vaping in Maryland

Engaging in Advocacy Efforts

As the vaping landscape in Maryland undergoes transformation, advocacy efforts become crucial for both businesses and consumers. Engaging with lawmakers, participating in public discussions, and staying informed about proposed regulations are essential steps in shaping the future of vaping in the state.

The Path Forward

Maryland’s journey into regulating vaping is far from over. The state’s policymakers, businesses, and the vaping community must collaboratively navigate the complexities of taxation and flavor restrictions. Finding a balanced approach that addresses public health concerns while respecting the rights and choices of adult vapers will likely be an ongoing challenge.

Conclusion: A Dynamic Vaping Landscape in Maryland

In conclusion, Maryland’s recent vape tax passage marks a significant development in the state’s regulatory journey. As businesses adapt to the new tax landscape and the flavored vape debate continues, the future of vaping in Maryland remains dynamic. The coming months will reveal the true impact of these changes on businesses, consumers, and the overall vaping community in the state.

0