Introduction

Start your blog post with an engaging introduction that highlights the importance of the European Commission’s proposal for an EU-wide minimum vape tax. Provide a brief overview of the topic and its significance.

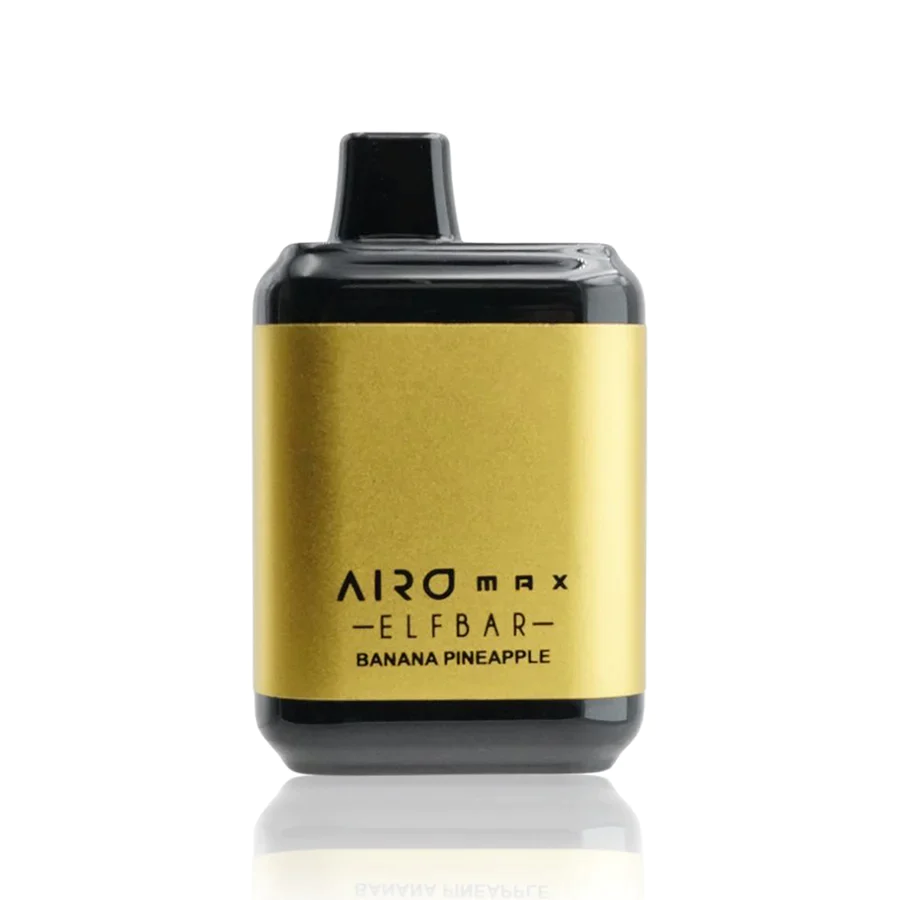

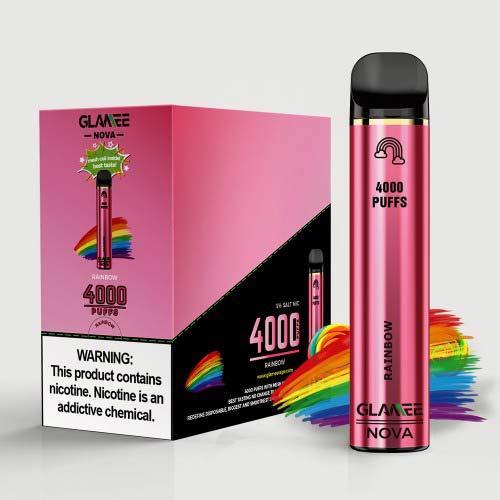

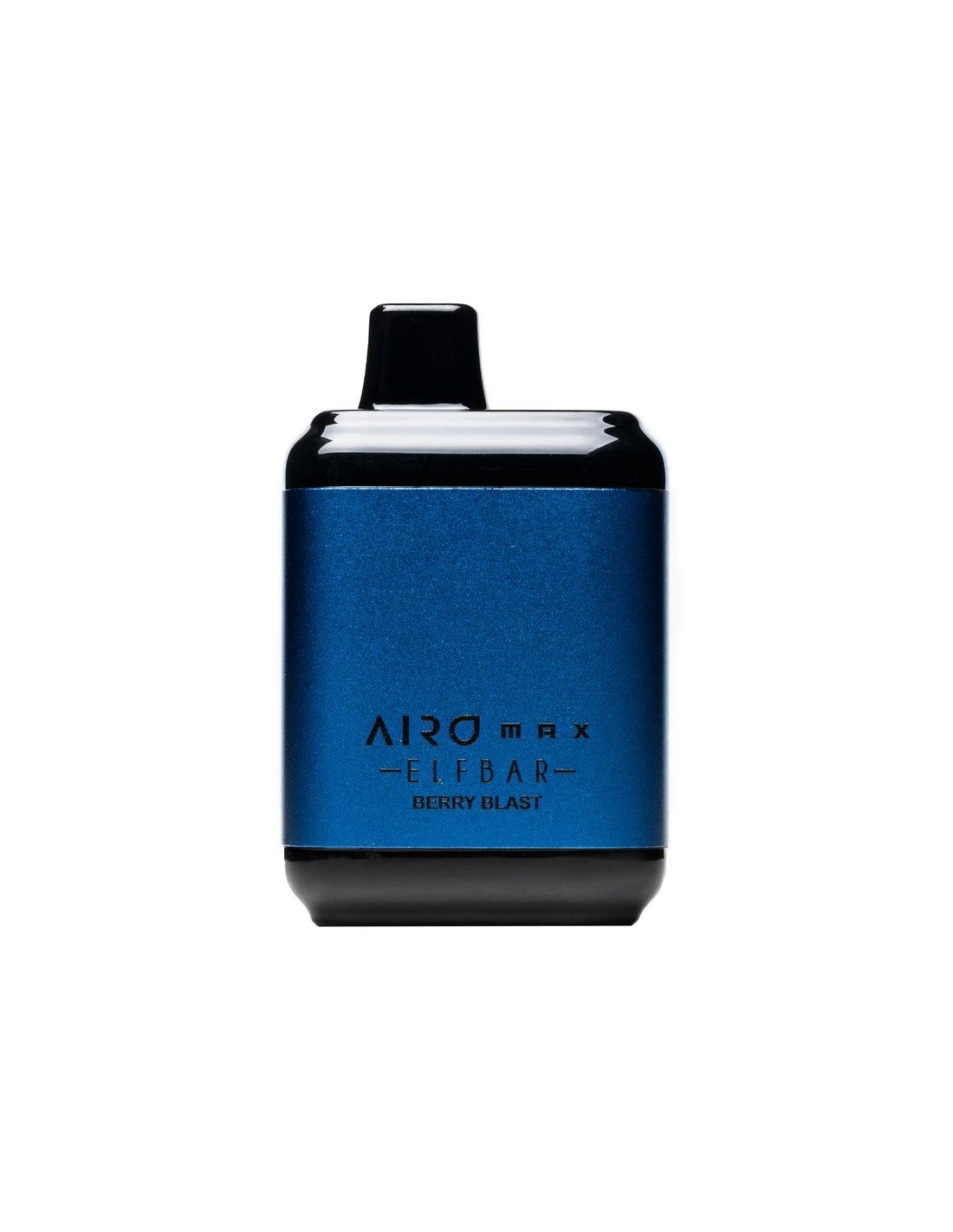

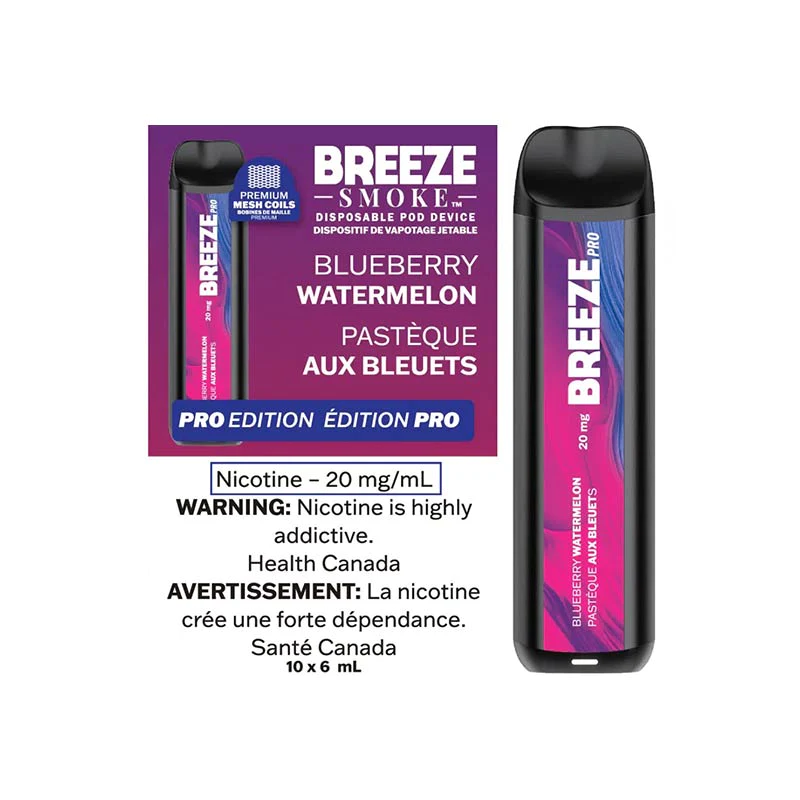

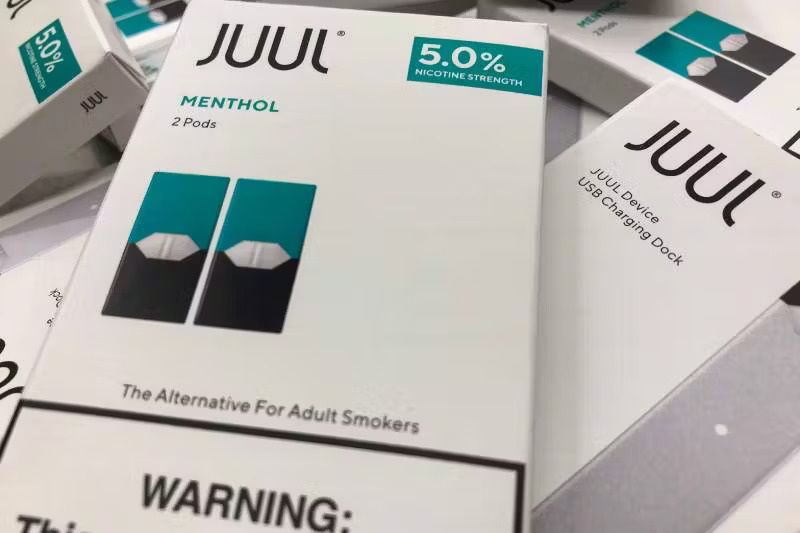

The Proposal and Its Implications

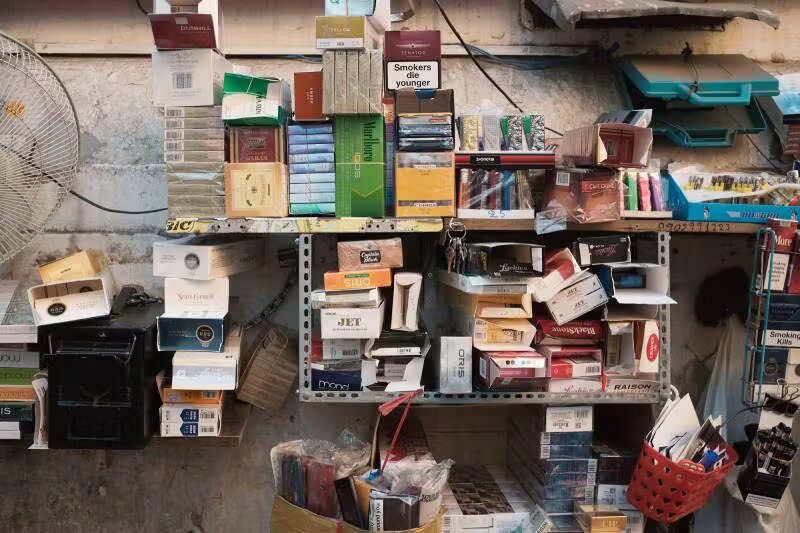

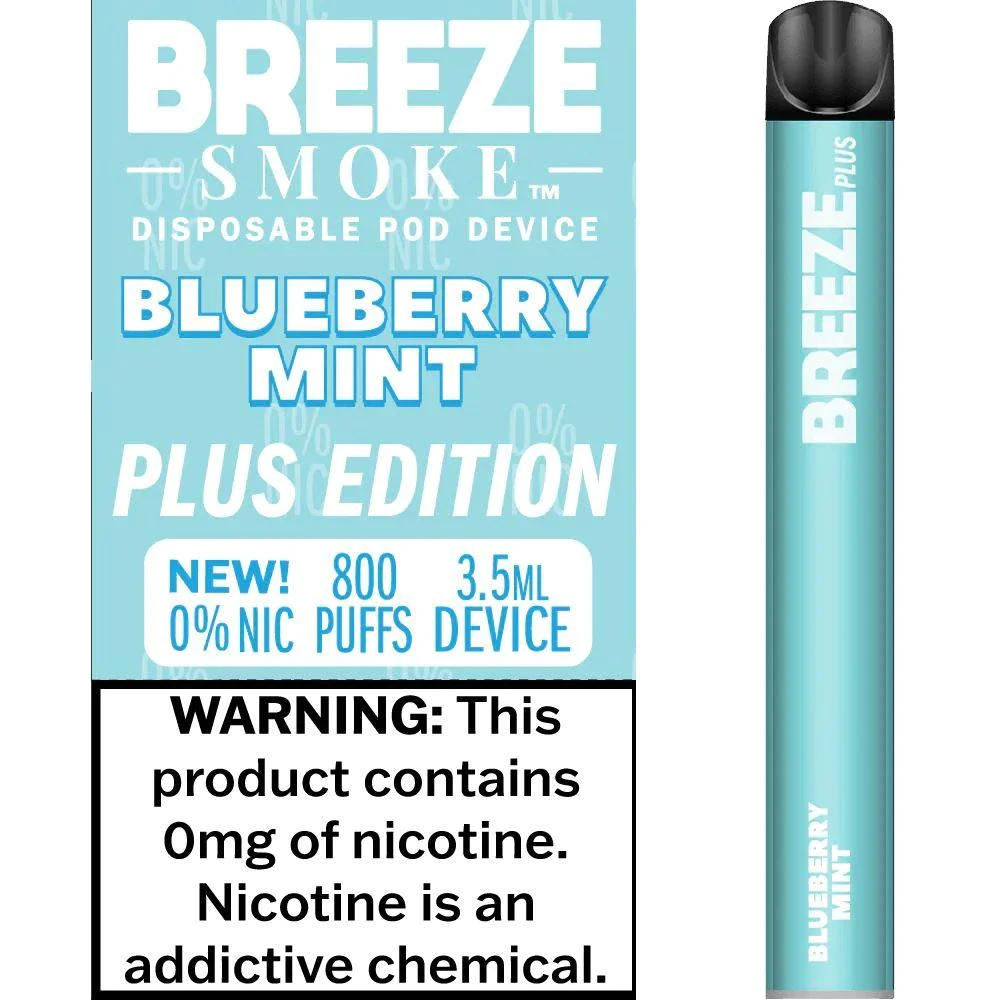

Discuss the details of the proposed vape tax, including its objectives, the suggested minimum tax rate, and the expected impact on the vaping industry. Analyze the potential benefits and drawbacks of the tax and its implications for manufacturers, retailers, and consumers.

Public Opinion and Stakeholder Reactions

Examine the response from various stakeholders, such as vaping associations, health organizations, and industry representatives. Discuss the diverse perspectives and debates surrounding the proposed vape tax and highlight any notable public opinions or concerns.

Next Steps and Potential Challenges

Outline the next steps in the process, including the timeline for the proposal’s implementation and the potential challenges that may arise during its adoption. Discuss any potential hurdles, legal considerations, or negotiations that need to be addressed.

Conclusion

Summarize the main points discussed in the blog post and offer your final thoughts on the European Commission’s proposal for an EU-wide minimum vape tax. Highlight the potential impact on the vaping industry and the importance of ongoing discussions and evaluations.

For more information, you can visit the official website of the European Commission.

0