Introduction

In a significant move that’s set to shape the vaping industry landscape, Italy is gearing up to reduce the e-liquid tax, effective from April 1st. This policy shift comes as a response to growing concerns and discussions surrounding vaping products and their impact on both public health and the economy. In this blog post, we’ll delve into the details of Italy’s decision to lower the e-liquid tax and the potential implications it might have.

Understanding the E-Liquid Tax Reduction

A Positive Step for Vaping Industry

Italy’s decision to lower the e-liquid tax is seen as a positive step that could have far-reaching effects on the vaping industry. The move reflects a willingness to strike a balance between consumer affordability, public health considerations, and the financial well-being of both consumers and businesses in the vaping sector. By reducing the tax, the government aims to promote vaping as a potentially less harmful alternative to traditional tobacco products.

Aligning with Health Goals

Lowering the e-liquid tax aligns with Italy’s broader health goals, particularly in combating smoking-related health issues. As vaping is often considered a harm reduction tool for smokers looking to quit or transition away from traditional cigarettes, a tax reduction could incentivize more smokers to explore vaping as a viable option. This shift could potentially lead to a decrease in smoking rates and, consequently, improve public health outcomes.

Implications and Considerations

Boosting the Vaping Market

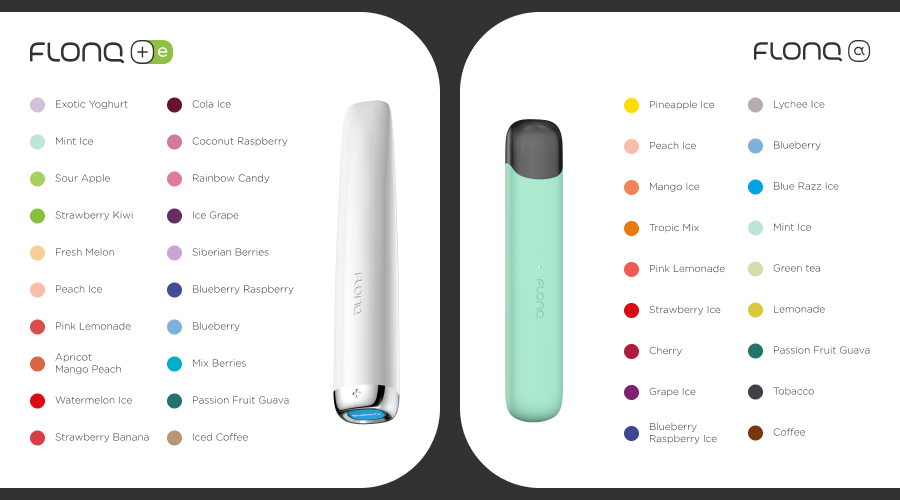

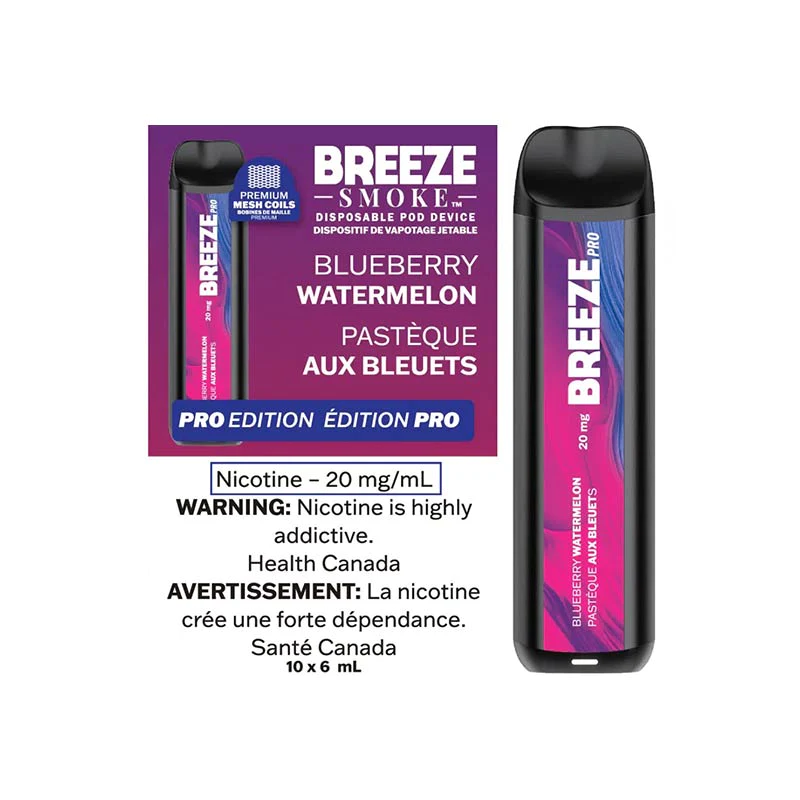

The reduction in e-liquid tax is expected to give a boost to the vaping market in Italy. With vaping products becoming more affordable, current vapers might be more inclined to continue using vaping as an alternative to smoking, while new users could be enticed to give it a try. This surge in demand could potentially stimulate innovation and growth within the vaping industry, leading to a broader range of products and flavors.

Economic Ramifications

The reduction in e-liquid tax could also have economic implications, positively affecting businesses in the vaping sector. Lower taxes could lead to increased sales, potentially driving revenue growth for manufacturers, distributors, and retailers alike. Additionally, reduced tax rates might encourage investments in the industry and create job opportunities, contributing to economic development.

Conclusion: Paving the Way for Vaping Advancement

A Step Toward a Balanced Approach

Italy’s decision to reduce the e-liquid tax reflects a commitment to fostering a balanced approach between public health considerations, consumer affordability, and industry growth. By incentivizing vaping as a harm reduction tool, the country sets an example for other nations to explore similar measures that prioritize public health while supporting an emerging industry.

As Italy prepares to implement the e-liquid tax reduction on April 1st, the vaping community and stakeholders eagerly await the outcomes of this policy change. It represents a milestone in the journey towards healthier alternatives and highlights the evolving perception of vaping within the global context.

Stay tuned for updates as Italy’s vaping industry undergoes transformation, driven by policies that aim to create a healthier and more sustainable future for all.

0