Introduction

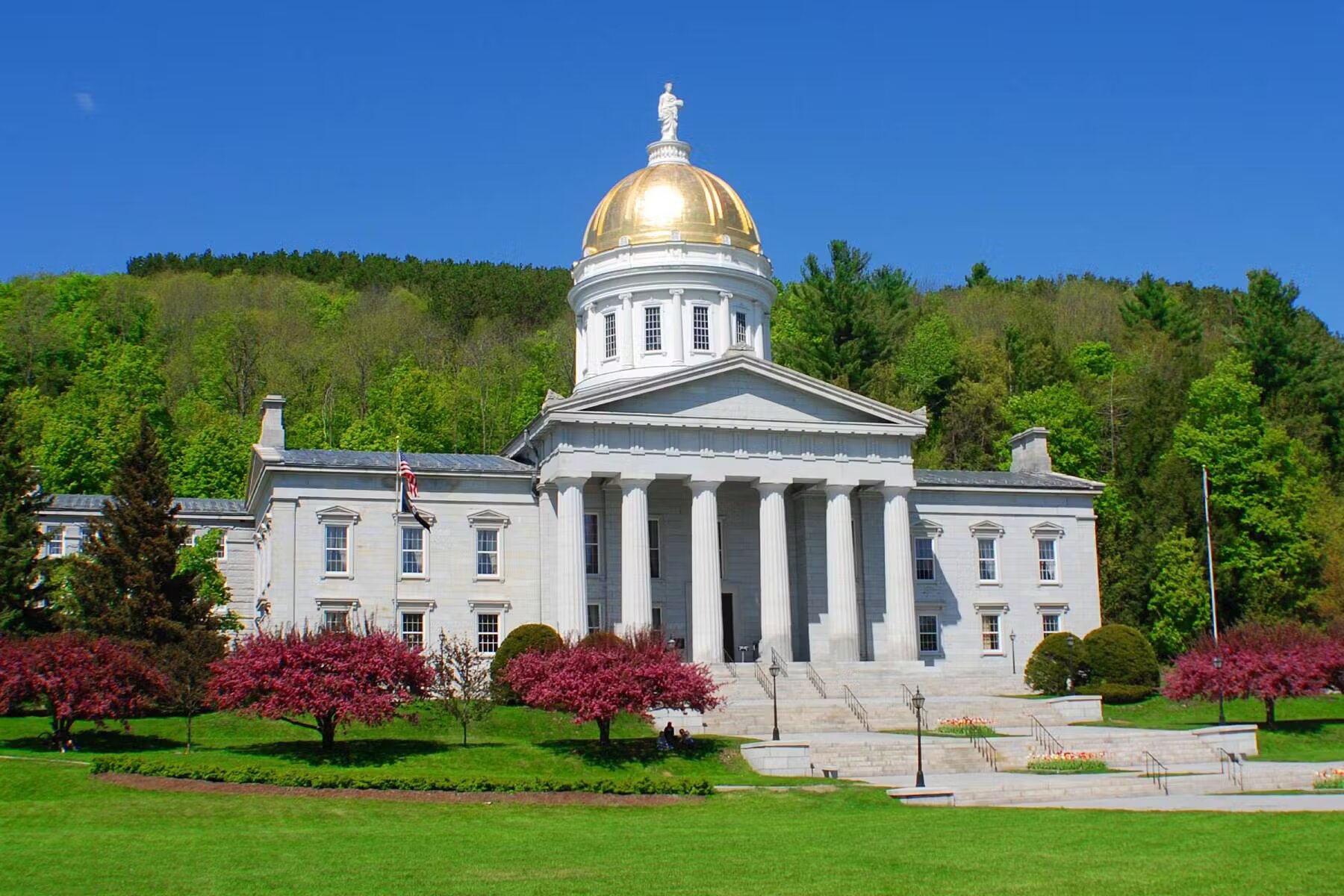

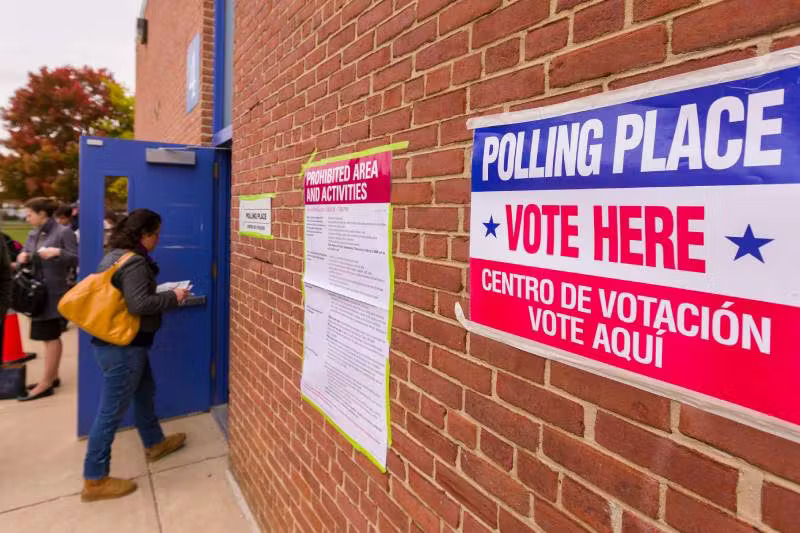

In a recent electoral turn, voters have made significant decisions related to the regulation and taxation

of vaping products and cannabis sales. This marks a noteworthy shift in the regulatory landscape, with

implications for public health, state revenues, and the evolving perception of these substances. Let’s

delve into the outcomes and their potential impact on the two industries.

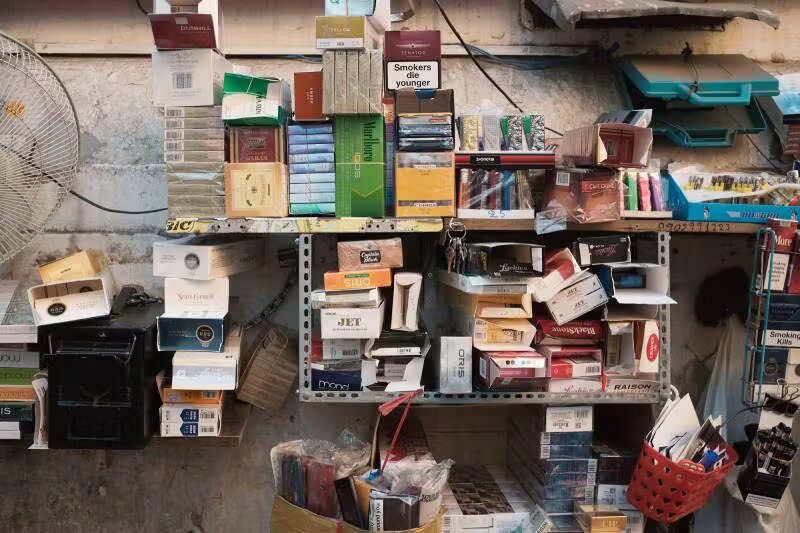

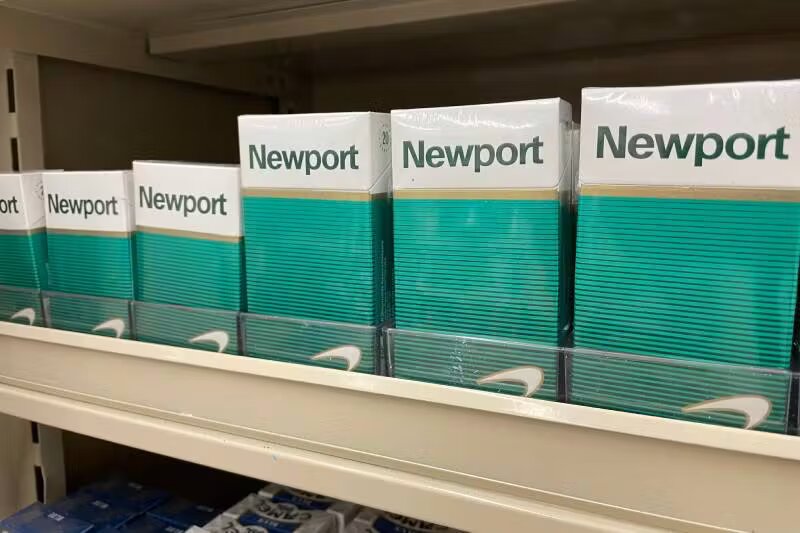

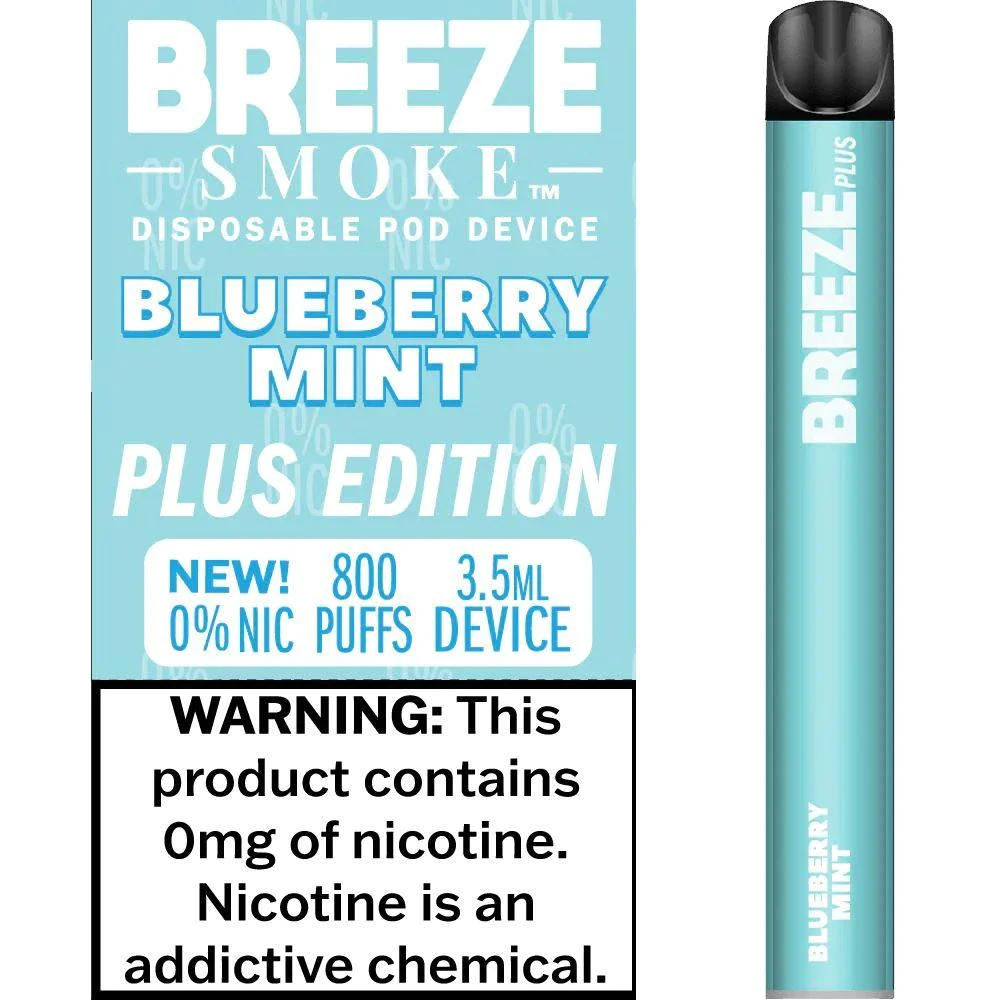

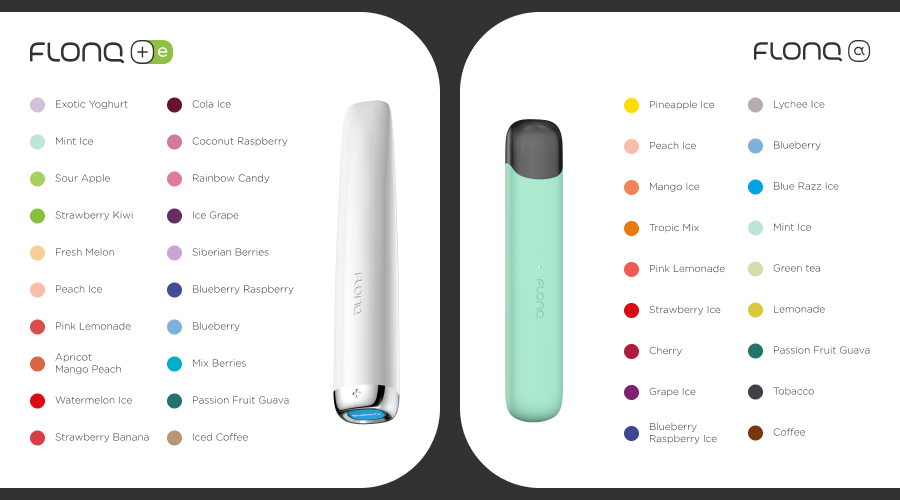

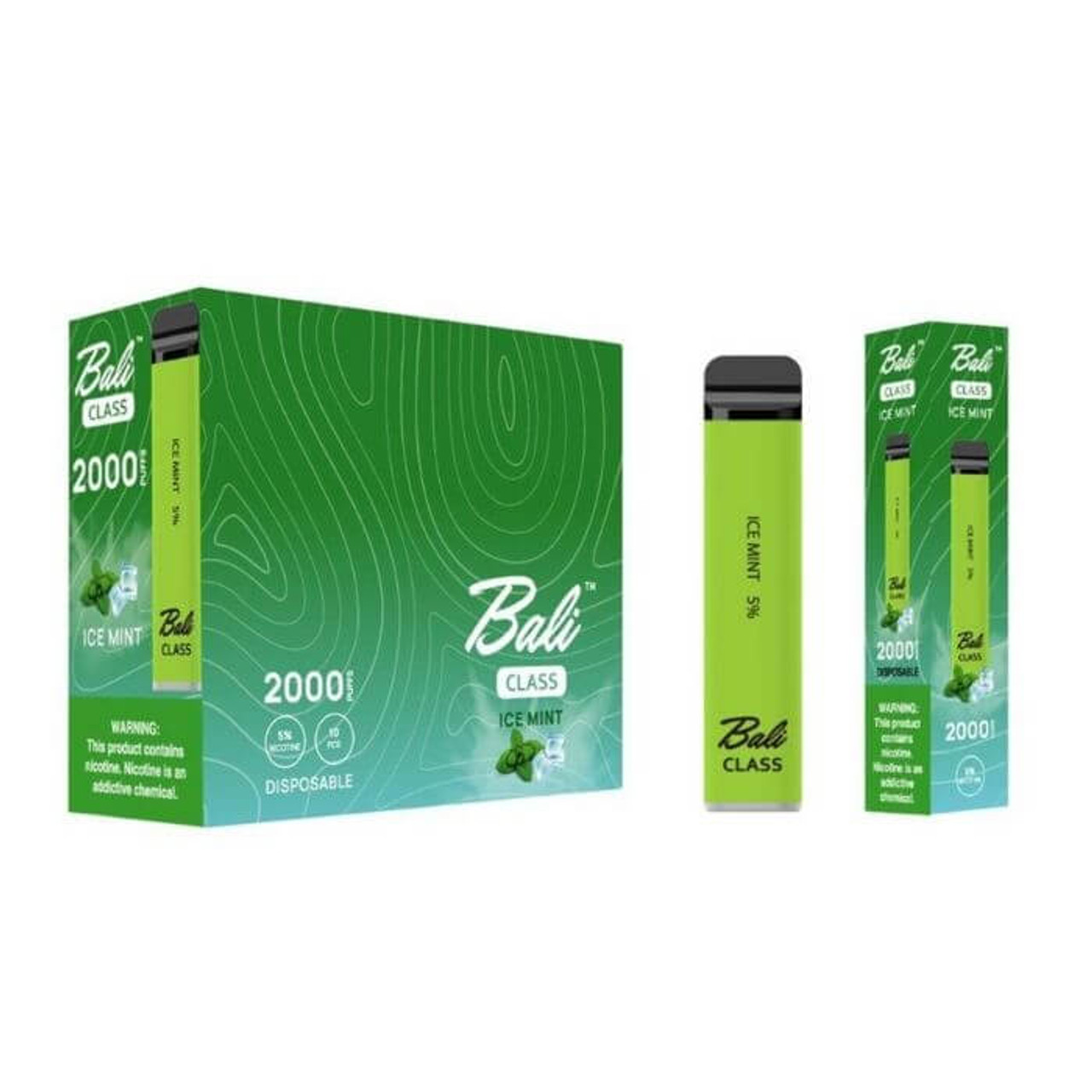

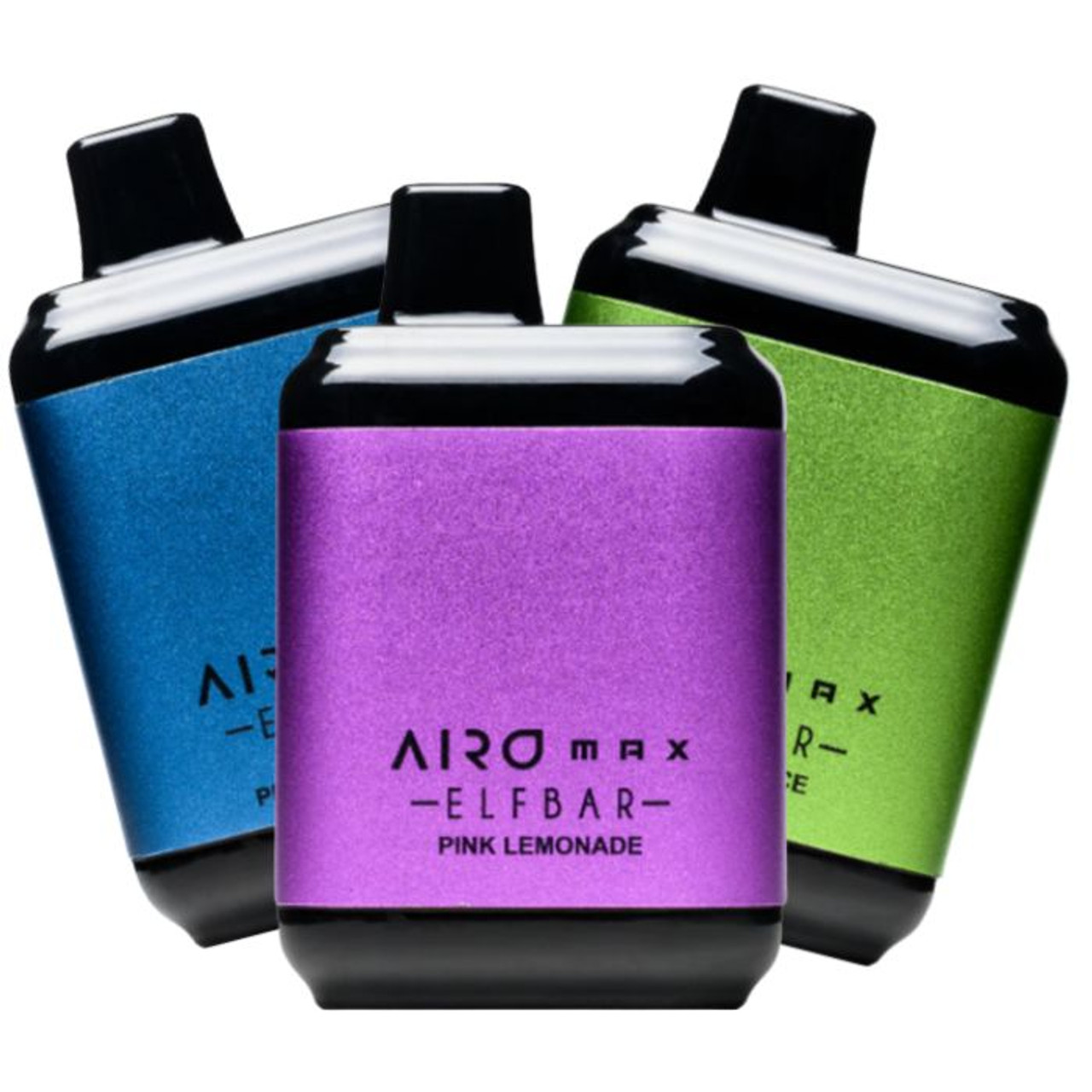

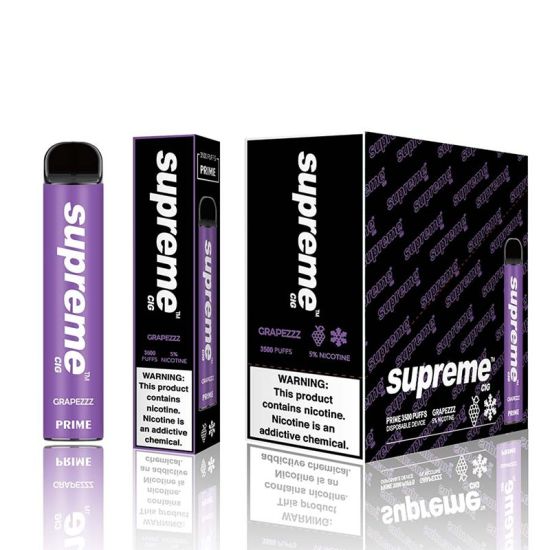

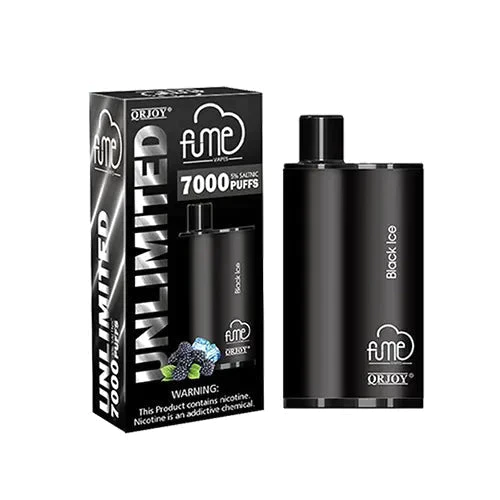

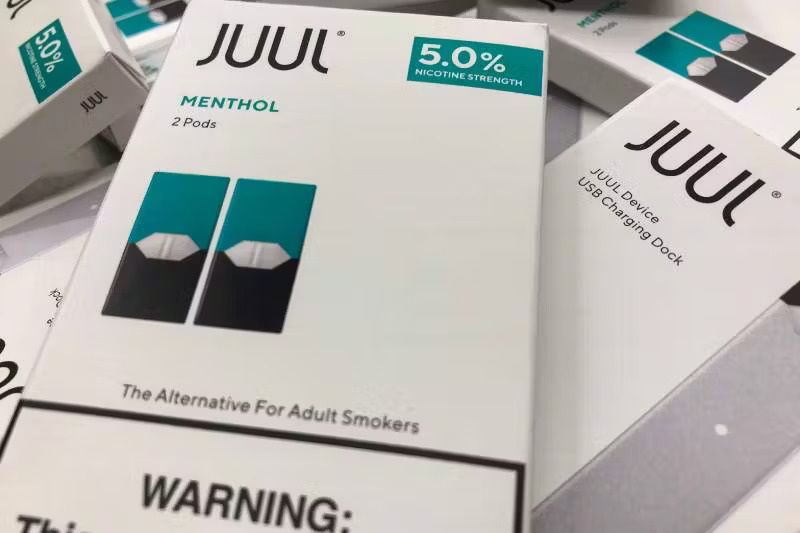

A New Era for Vape Regulation

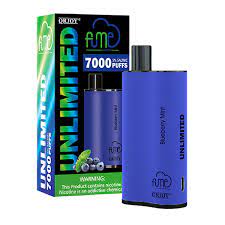

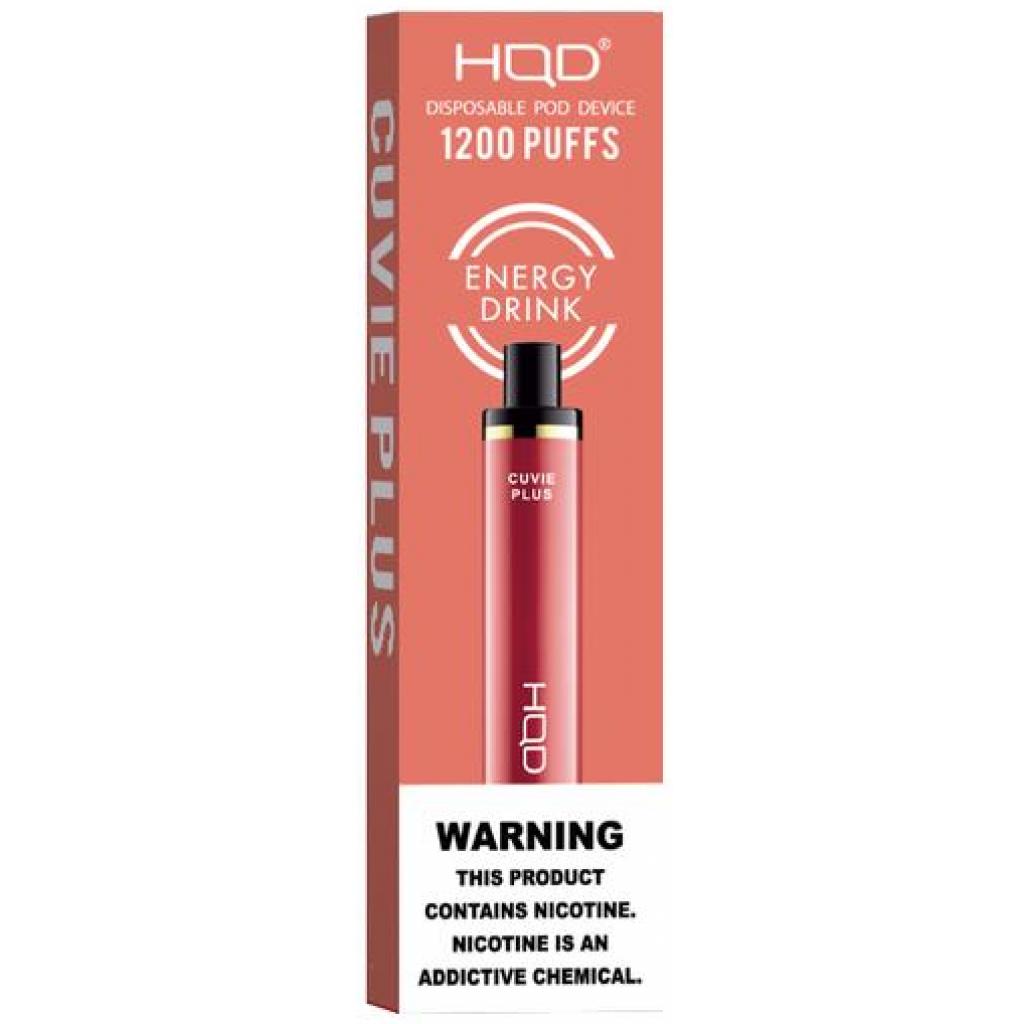

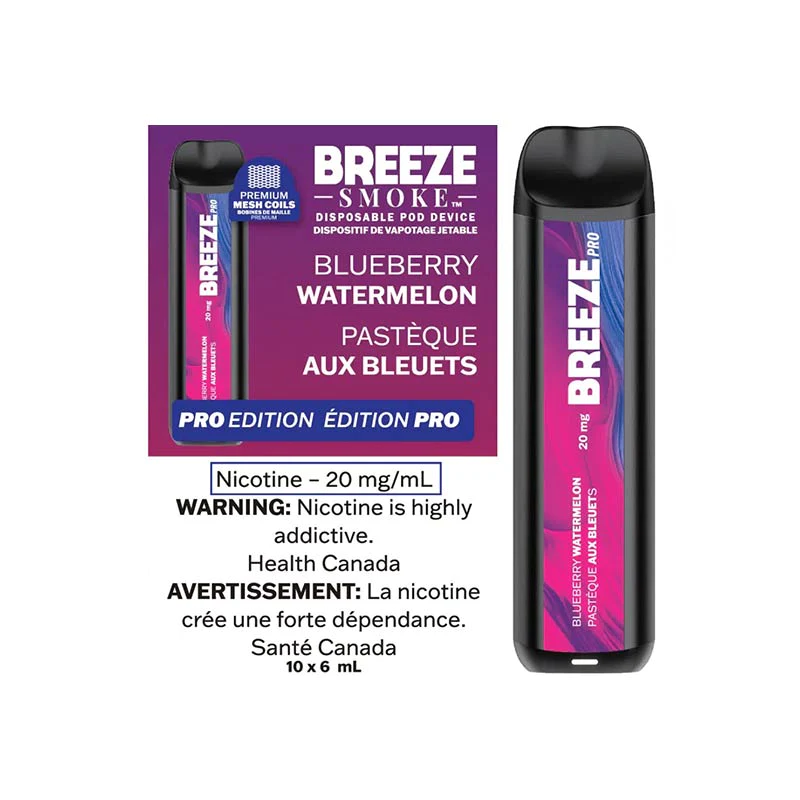

In State A and State B, voters have given their nod to the imposition of taxes on vape products. This

decision reflects a growing concern about the use of electronic cigarettes, especially among younger

demographics. The approved vape taxes aim to not only generate additional state revenue but also act as

a deterrent to curb the rising popularity of vaping among teenagers.

Implications for Public Health

The approval of vape taxes underscores a heightened awareness of the health risks associated with vaping.

As policymakers respond to the surge in youth vaping, these taxes are positioned as tools to discourage

consumption. The revenue generated from these taxes is expected to be earmarked for public health

initiatives, creating a cyclical approach to addressing the challenges posed by the vaping epidemic.

Cannabis Sales Expand in Five States

Simultaneously, in a separate electoral development, voters in five states have given the green light to

the legal sale of cannabis. This expansion of cannabis legalization reflects a broader societal

acceptance and evolving attitudes towards the recreational and medicinal use of marijuana.

Economic Impact

The approval of cannabis sales is poised to have a substantial economic impact on the states involved. By

legalizing and regulating the cannabis market, these states are not only addressing the demands of a

burgeoning industry but also creating new avenues for job creation and tax revenue generation. The

economic benefits are expected to extend beyond the cannabis industry itself, positively influencing

related sectors.

Conclusion

Navigating a Changing Landscape

The recent electoral decisions regarding vape taxes and cannabis sales signify a changing regulatory

landscape. As states grapple with evolving public sentiments and health considerations, these decisions

showcase a nuanced approach to balancing industry growth, public health, and state revenues. The coming

months and years will be crucial in assessing the effectiveness of these measures and understanding

their broader implications for both the vaping and cannabis industries.

In conclusion, the approved vape taxes and expanded cannabis sales mark a pivotal moment in the ongoing

conversation around substance regulation. The outcomes reflect the intricate dance between societal

attitudes, economic considerations, and public health priorities, shaping the future trajectory of these

industries.

0