Understanding the Potential Impact on Vaping Community

In a recent announcement, the United Kingdom government has revealed plans to propose a vape tax in March.

This move has sparked discussions and concerns within the vaping community, raising questions about the potential impact on both consumers and the industry.

The Details of the Proposed Vape Tax

When Will the Tax Take Effect?

The proposed vape tax is expected to be officially introduced in March of this year.

This timeline gives businesses and consumers some time to prepare for potential changes in pricing and regulations related to vaping products.

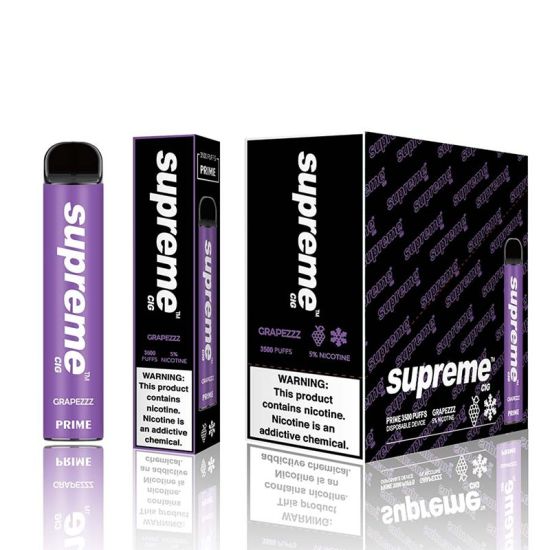

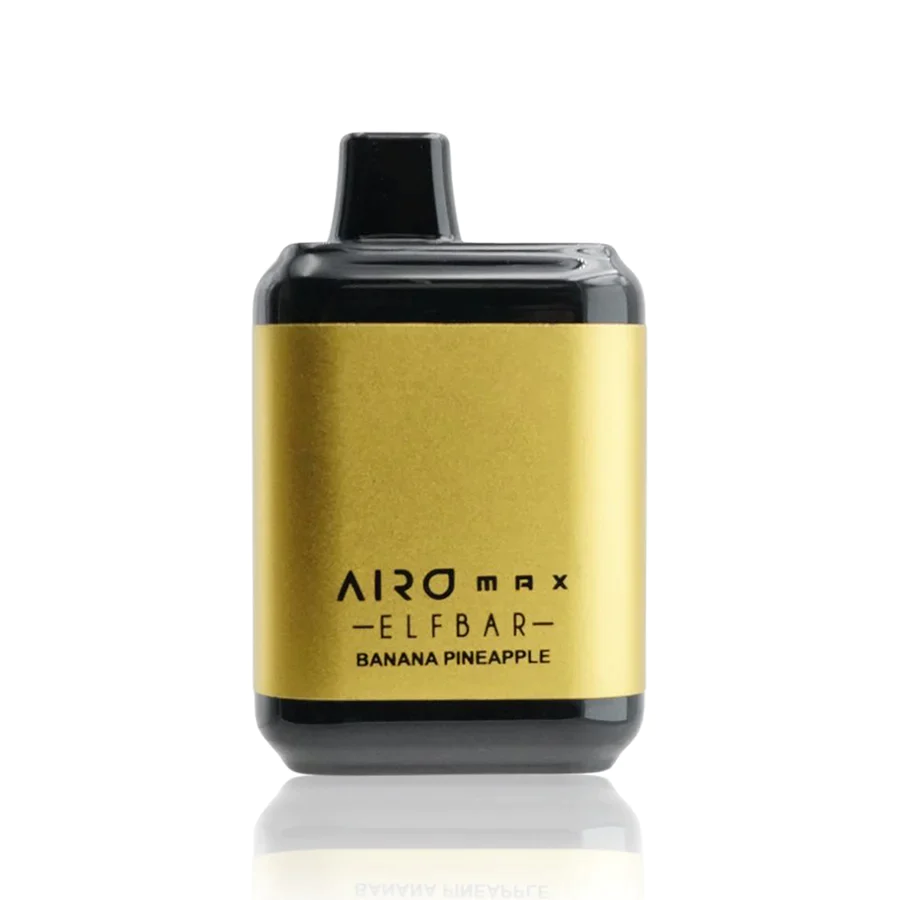

What Products Will Be Affected?

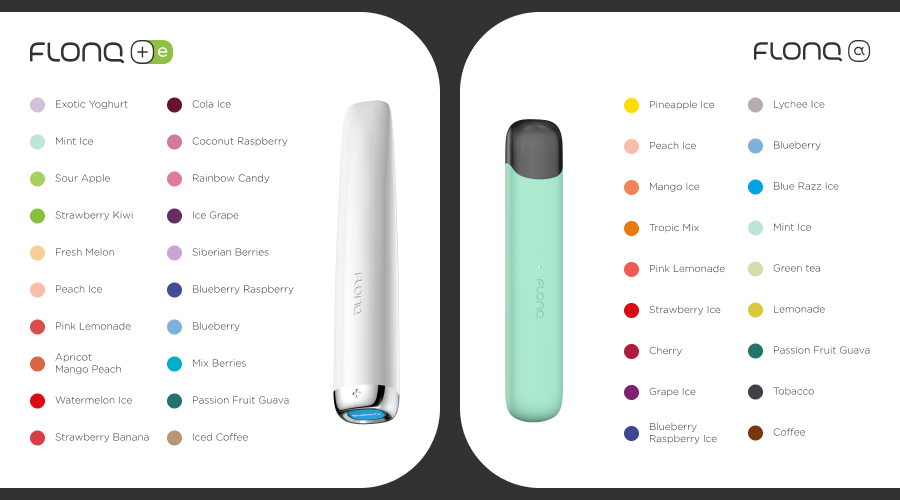

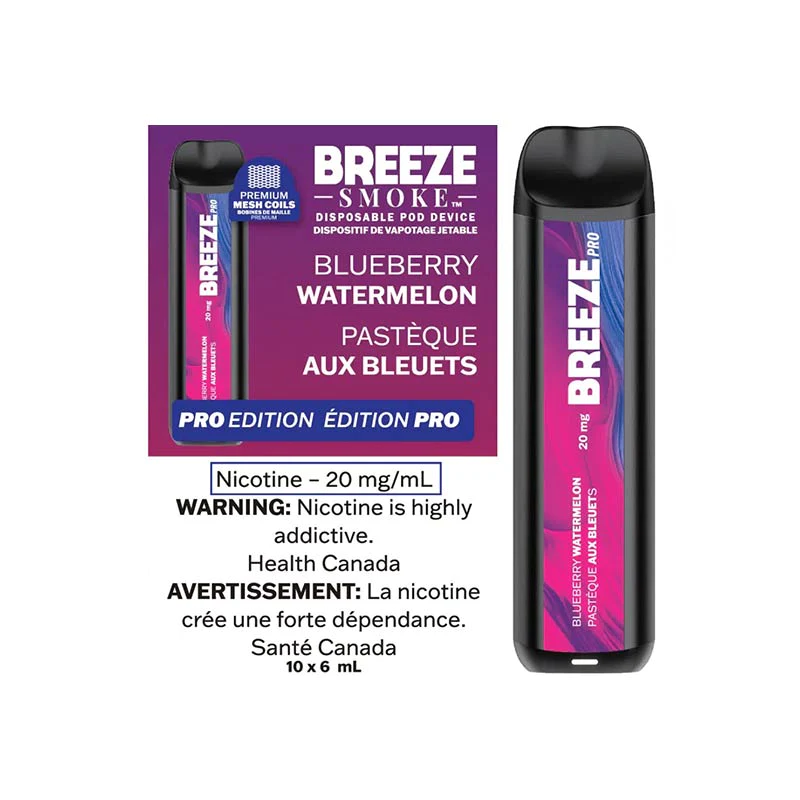

While the specific details of the proposed tax are yet to be fully disclosed, it is anticipated that a wide range of vaping products may be subject to taxation.

This could include e-cigarettes, vape pens, e-liquids, and related accessories.

The government aims to create a comprehensive framework that covers various aspects of the vaping industry.

The Rationale Behind the Vape Tax Proposal

Health and Financial Considerations

The government justifies the proposed vape tax as a measure to address both public health concerns and financial considerations.

By imposing a tax on vaping products, authorities aim to generate additional revenue while potentially discouraging excessive use, especially among younger individuals.

Supporting Smoking Cessation Programs

A portion of the revenue generated from the vape tax is earmarked to fund smoking cessation programs and public health initiatives.

This aligns with the government’s broader strategy to reduce smoking rates and promote healthier alternatives.

Potential Implications for Consumers

Price Adjustments and Consumer Behavior

With the introduction of a vape tax, consumers may experience changes in the pricing of their favorite vaping products.

This could influence purchasing decisions and lead some individuals to explore more cost-effective alternatives or consider quitting altogether.

Staying Informed and Advocacy

Vapers and vaping businesses are encouraged to stay informed about the developments surrounding the proposed tax.

Additionally, advocacy groups may play a crucial role in representing the interests of the vaping community and ensuring that any imposed tax is fair and reasonable.

Conclusion: Navigating the Future of Vaping in the UK

As theUK government gears up to propose a vape tax in March , the vaping community must remain vigilant and proactive.

Staying informed, participating in discussions, and advocating for fair regulations will be essential in shaping the future landscape of vaping in the United Kingdom.

0