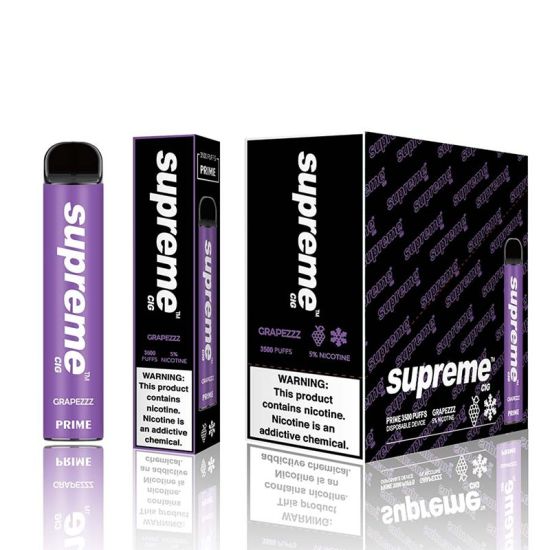

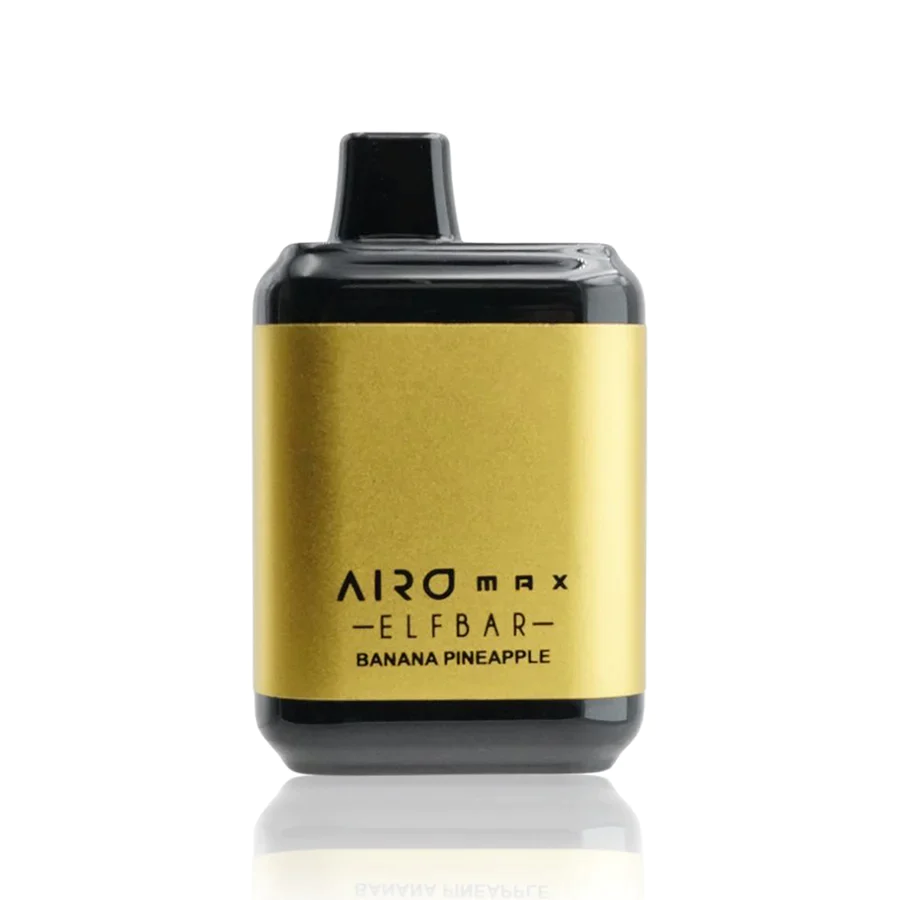

In a significant development, Cyprus has recently passed legislation to impose a tax on e-liquid, marking a pivotal moment for both the vaping community and the e-cigarette industry. This move is set to have profound implications, sparking discussions on the economic, regulatory, and health aspects of vaping in the country.

Understanding Cyprus’ Decision

Cyprus decision to introduce a tax on e-liquid stems from a combination of economic considerations and a growing awareness of health concerns associated with vaping. This tax is part of a broader strategy to regulate the vaping industry, ensure product quality, and generate revenue for public services.

What Vapers Need to Know

Vapers in Cyprus will now need to familiarize themselves with the intricacies of the newly introduced tax structure. The tax is likely to be applied to the volume or nicotine content of e-liquids, impacting the overall cost of vaping. Understanding the specifics of this taxation is crucial for both consumers and businesses operating in the e-cigarette sector.

Balancing Health and Financial Considerations

As the cost of e-liquid rises due to taxation, vapers may find themselves facing higher expenses to maintain their vaping habits. This shift in affordability prompts a reconsideration of choices for individuals who have adopted vaping as an alternative to traditional smoking. Striking a balance between health priorities and budget constraints will become a key challenge for many.

Charting the Future of Vaping in Cyprus

As Cyprus takes a significant step in regulating the e-cigarette industry through the imposition of a tax on e-liquid, the landscape for vapers and businesses alike is undergoing a transformation. Navigating this evolving terrain requires a delicate balance between economic considerations, public health priorities, and industry adaptation. The coming months will undoubtedly shed light on how this decision shapes the future of vaping in Cyprus and potentially influences global perspectives on e-cigarette taxation.

0