In a significant move that has sparked both debate and concern, Indonesia has recently announced its decision to impose taxes on vaping products. This regulatory measure aims to protect the nation’s thriving cigarette industry, raising questions about the potential impacts on the vaping community and the broader tobacco landscape.

The Implications of Indonesia’s Vape Tax

As the Indonesian government takes steps to regulate the vaping market through taxation, several implications emerge that warrant attention:

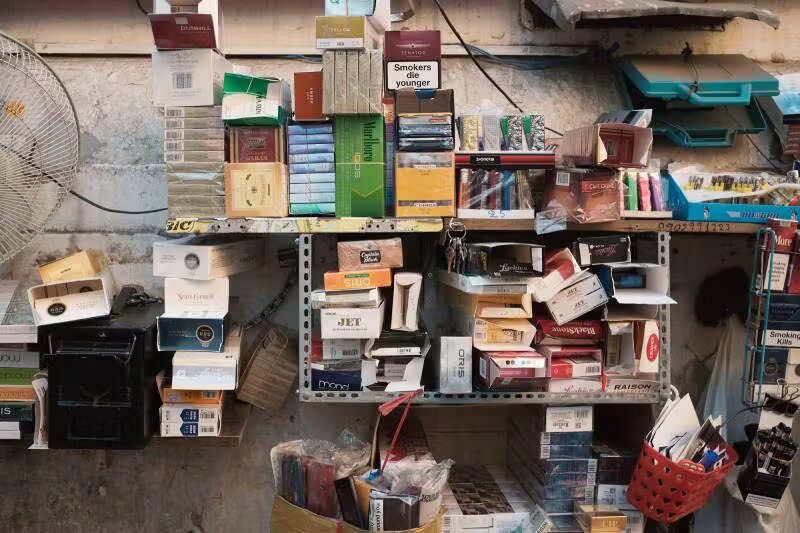

1. Protection of the Cigarette Industry

The primary objective behind the vape tax is to safeguard the interests of the established cigarette industry in Indonesia. By imposing taxes on vaping products, the government aims to maintain the dominance and revenue generated by traditional tobacco products.

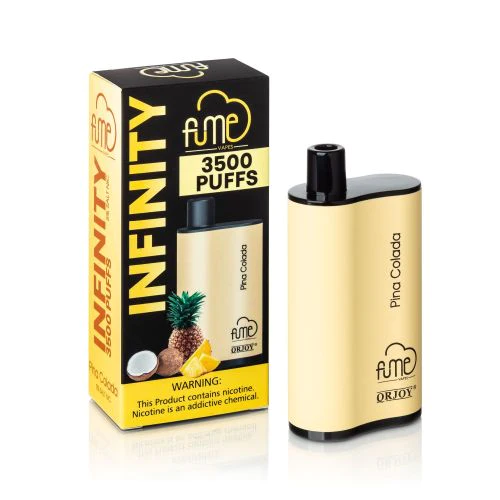

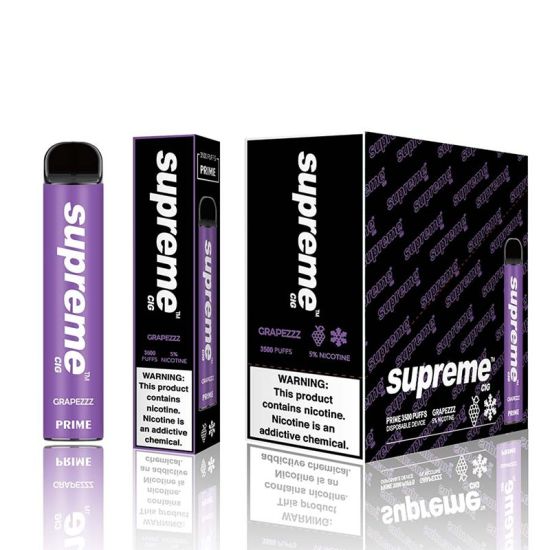

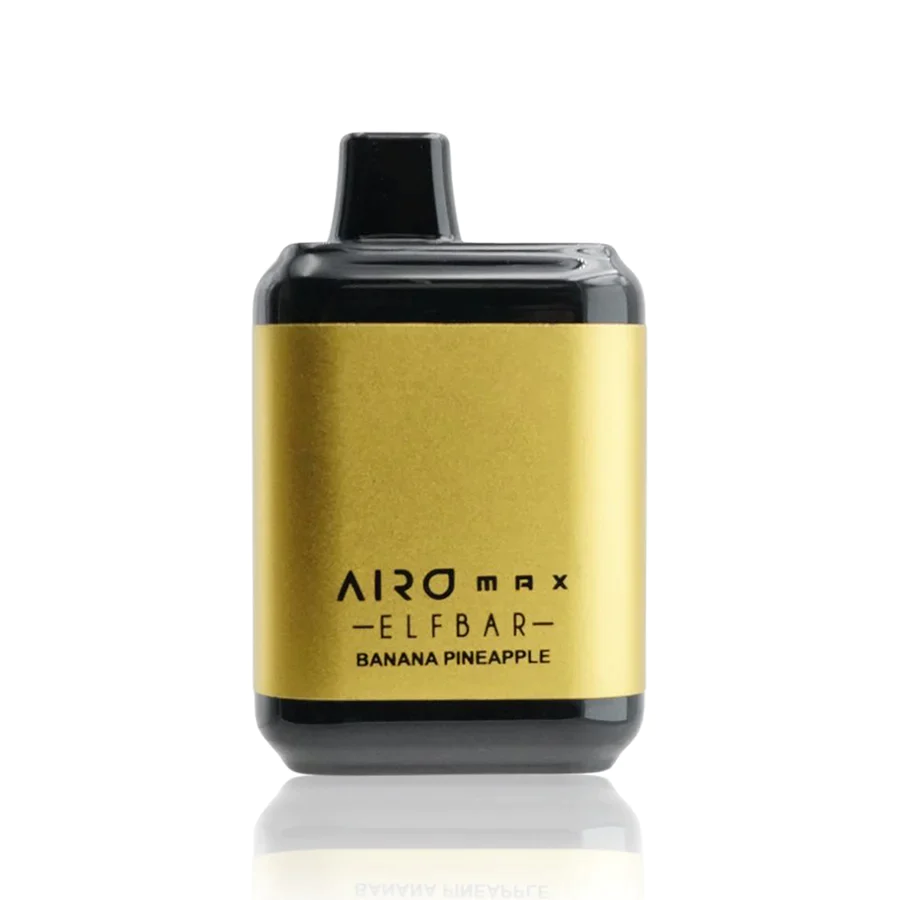

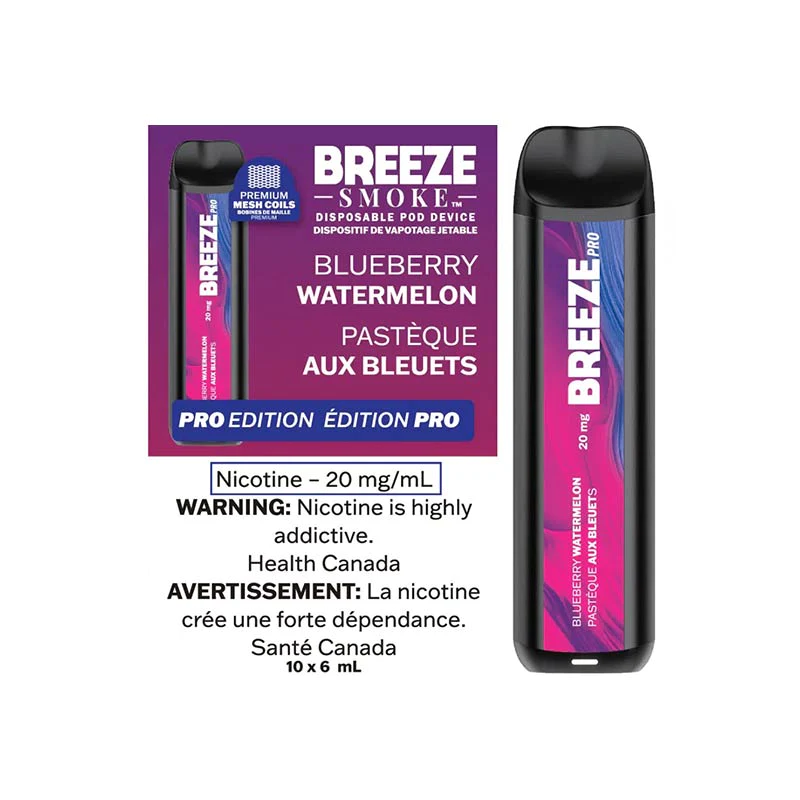

2. Impact on the Vaping Community

For the vaping community, this move raises concerns about affordability and accessibility. The introduction of taxes may lead to increased prices for vaping products, potentially limiting the choices available to consumers and making it less attractive as an alternative to smoking.

3. Controversies Surrounding Tobacco Regulation

The decision to tax vapes has ignited controversies regarding the government’s role in regulating tobacco-related products. Advocates argue that vaping can be a less harmful alternative to smoking, and taxing it heavily may discourage smokers from making the switch to a potentially safer option.

Public Reaction and Potential Consequences

Public Discourse and Opposition

Unsurprisingly, Indonesias decision to tax vapes has triggered a robust public. Some sectors argue that the government should focus on promoting harm reduction and smoking cessation rather than implementing measures that could limit alternatives for smokers.

Potential Economic Ramifications

There are concerns about the economic consequences of this taxation strategy. The vape industry has been a growing market globally, and Indonesia’s move could impact the growth of local and international vape businesses, potentially affecting employment and economic contributions related to the industry.

Conclusion: Navigating the Intersection of Regulation and Innovation

As Indonesia takes a bold step in taxing vapes to protect the cigarette industry, the landscape of tobacco regulation continues to evolve. Striking a balance between safeguarding established industries and encouraging harm reduction through innovative alternatives remains a challenge. The journey ahead involves careful consideration of the diverse perspectives and potential consequences associated with this regulatory decision.

0