Unpacking the Controversy Surrounding Indiana’s Vaping Tax Decision

Indiana has recently made headlines in the vaping community as it passes a new tax specifically targeting vaping products. What sets this decision apart is the absence of public input, sparking a wave of controversy and concerns regarding transparency in the legislative process.

The Lack of Public Input: A Cause for Concern

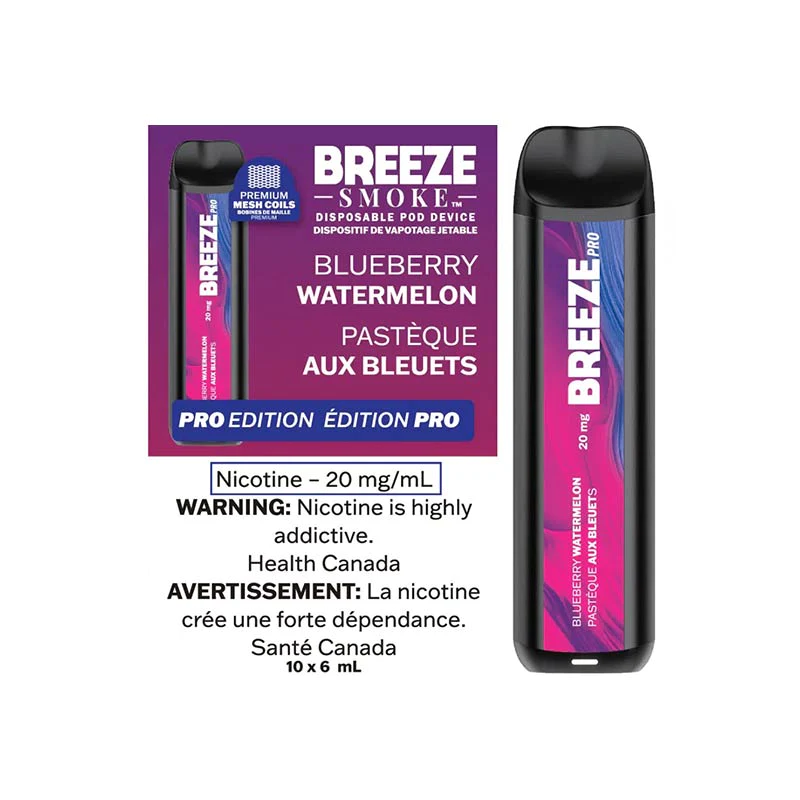

- Taxing Vaping Products: The core of the issue lies in Indiana’s decision to impose a tax on vaping products without seeking input from the public. This move has ignited debates about the fairness of taxing a rapidly growing industry without allowing those affected a voice in the matter.

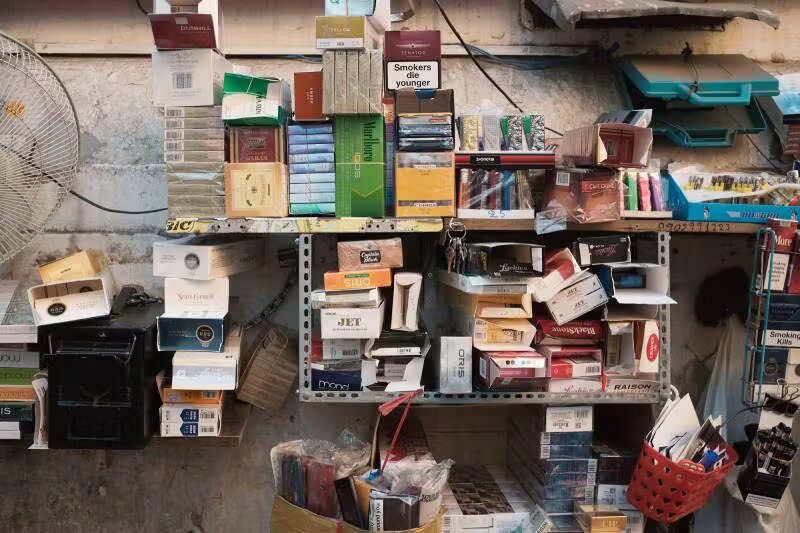

- Impact on Consumers and Businesses: The vaping community, including both consumers and businesses, now faces the repercussions of a tax that may not align with their needs and concerns. The lack of public input raises questions about the government’s understanding of the vaping industry and its potential consequences.

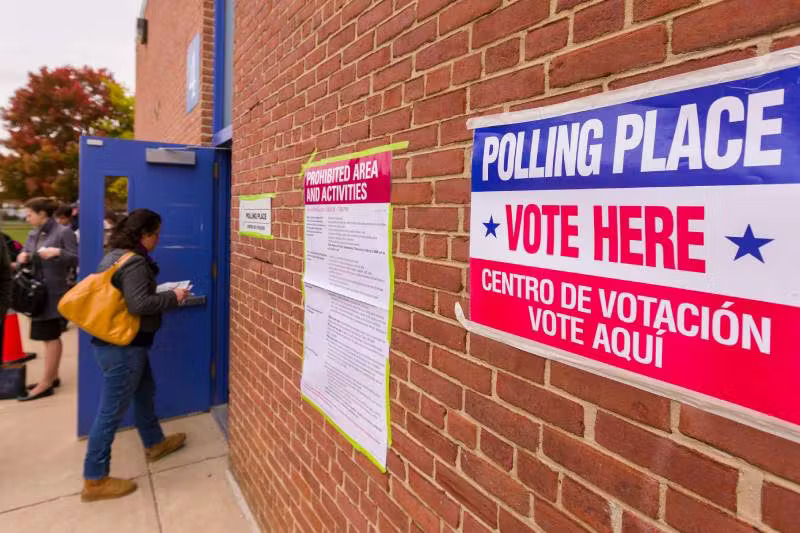

- Transparency in Legislation: Transparency in legislative processes is a cornerstone of a democratic society. The absence of public input in this tax decision challenges the principles of open governance and calls into question the accessibility of decision-making for the citizens of Indiana.

The Industry Responds: Advocacy and Concerns

- Vaping Advocacy Groups: Advocacy groups within the vaping industry have expressed their concerns, emphasizing the importance of including diverse perspectives in decisions that impact a broad demographic. Efforts are underway to engage lawmakers and highlight the need for fair representation.

- Small Businesses Feeling the Pinch: Small businesses in the vaping sector, often operating on thin profit margins, are particularly affected by this tax. The absence of public input means these businesses may struggle to adapt to the financial implications, potentially leading to closures and job losses.

What’s Next for Indiana’s Vaping Community?

- Legal Challenges and Lobbying: With the controversy surrounding this tax decision, legal challenges and lobbying efforts are expected to increase. Vaping advocates aim to create a platform for public input and ensure that future decisions consider the diverse perspectives within the community.

- Community Engagement and Awareness: As the fallout continues, community engagement and awareness-building initiatives become crucial. Educating the public on the impact of such decisions and fostering a sense of collective voice is essential for a more inclusive legislative process.

In conclusion, Indiana’s decision to pass a vaping tax without public input raises fundamental questions about representation and transparency in governance. As the vaping community navigates the aftermath, the hope is for a more inclusive approach that considers the diverse perspectives within this rapidly evolving industry.

0