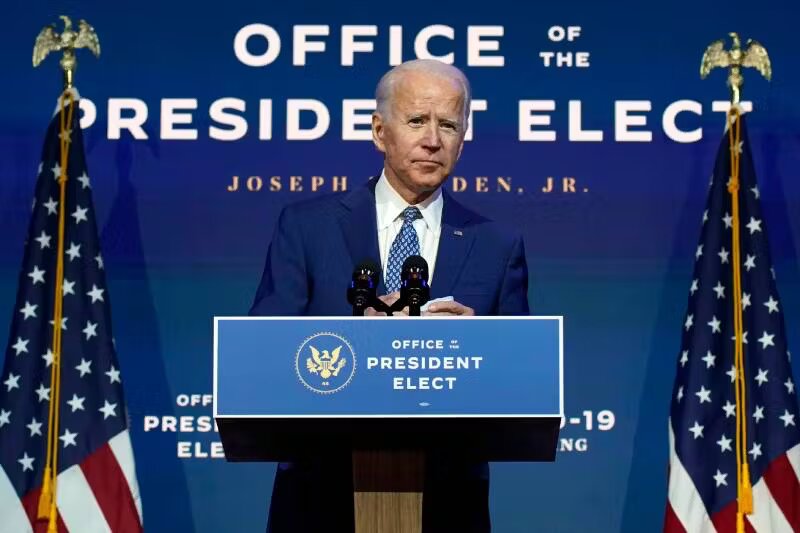

Understanding the CVA’s Plea

In a recent development, the Canadian Vaping Association (CVA) has called for a comprehensive reconsideration of the proposed tax on e-cigarettes. The advocacy group, representing various stakeholders in the vaping industry, emphasizes the need for a nuanced approach to e-cigarette taxation and urges policymakers to carefully evaluate the potential impact on both businesses and consumers.

The Context of the Tax Proposal

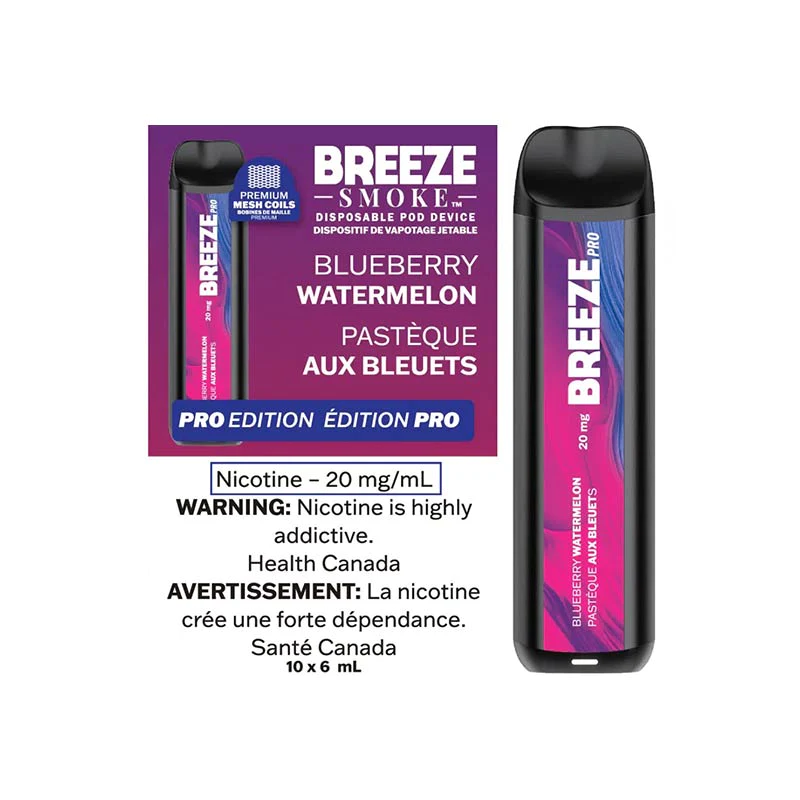

The proposed tax on e-cigarettes aims to address public health concerns and generate revenue. However, the CVA contends that a one-size-fits-all taxation approach might have unintended consequences. As the vaping industry plays a pivotal role in harm reduction by providing an alternative to traditional smoking, the CVA argues that taxing e-cigarettes excessively could undermine the progress made in reducing smoking rates.

The Economic and Health Considerations

The CVA’s call for reconsideration is grounded in a dual concern for both economic viability and public health. Excessive taxation, according to the association, could lead to job losses within the vaping industry and limit consumer access to harm reduction alternatives. Striking a balance between taxation and harm reduction is crucial to ensuring the continued success of vaping as a smoking cessation tool.

Collaborative Dialogue for a Balanced Solution

Rather than outright opposition, the CVA encourages a collaborative dialogue between industry stakeholders and policymakers to develop a tax framework that addresses public health goals without stifling the growth of the vaping sector. By fostering open communication, the association believes that a balanced solution can be achieved, satisfying both economic and health-related objectives.

Moving Forward: Advocacy and Engagement

As the discussions surrounding e-cigarette taxation unfold, the CVA remains committed to advocating for the interests of its members and the broader vaping community. Through engagement with policymakers, health organizations, and the public, the association aims to contribute to the development of fair and effective policies that prioritize both public health and the economic vitality of the vaping industry.

In conclusion, the CVA’s call for the reconsideration of the e-cigarette tax proposal reflects a nuanced approach to balancing economic interests and public health goals. As Canada navigates the complexities of regulating the vaping industry, collaborative efforts between stakeholders and policymakers will be essential to finding a solution that supports harm reduction initiatives while ensuring the sustainability of the vaping sector.

0