The Controversy Surrounding Vape Tax in Israel

Israel has been at the center of a heated debate surrounding its tax policy on vaping products. A critical decision lies ahead as a committee prepares to determine whether to maintain the extreme vape tax in place. This decision has far-reaching implications for both the vaping industry and public health.

The Vape Tax Landscape in Israel

Understanding the Current Taxation

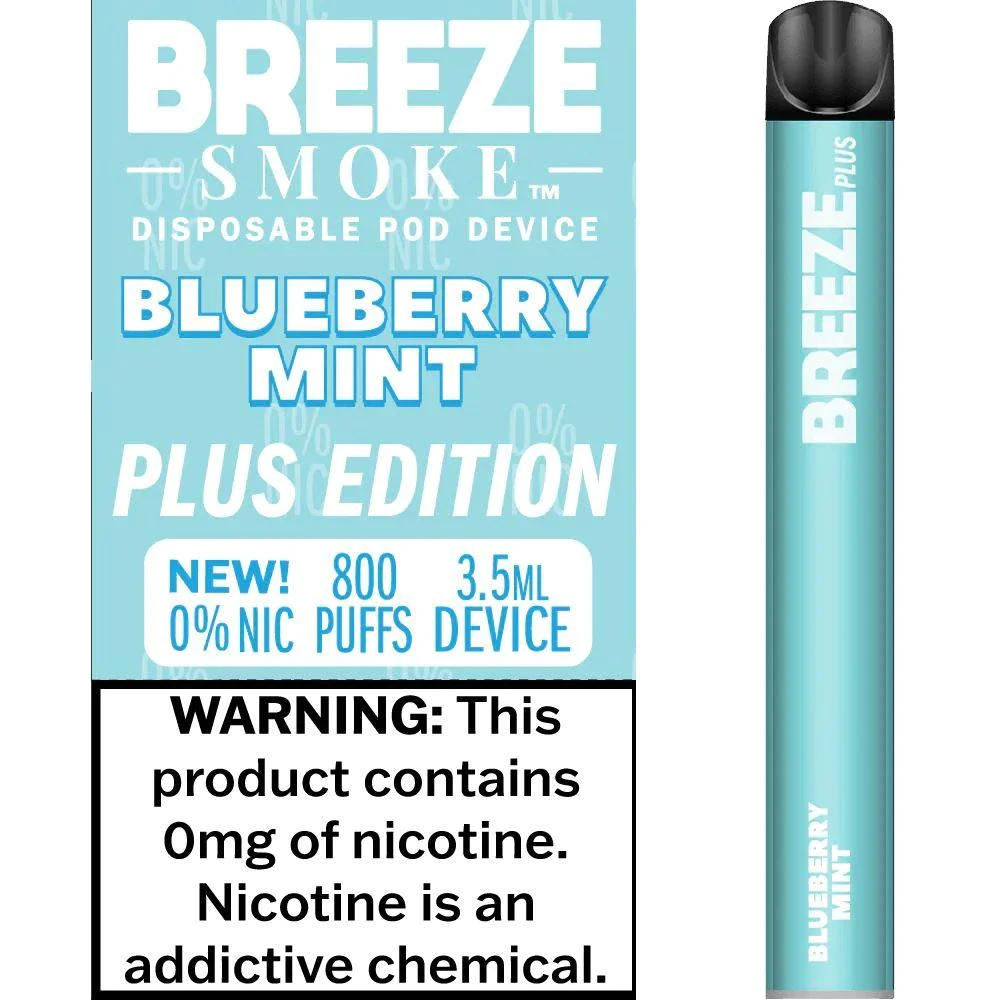

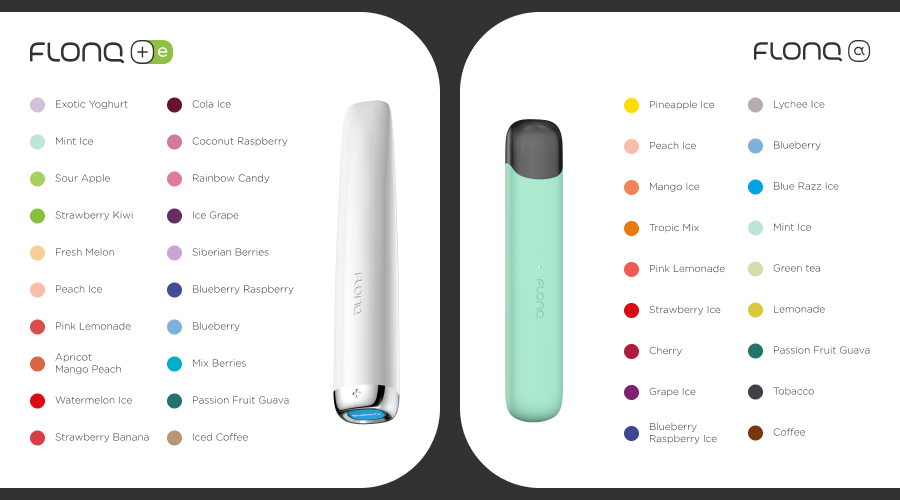

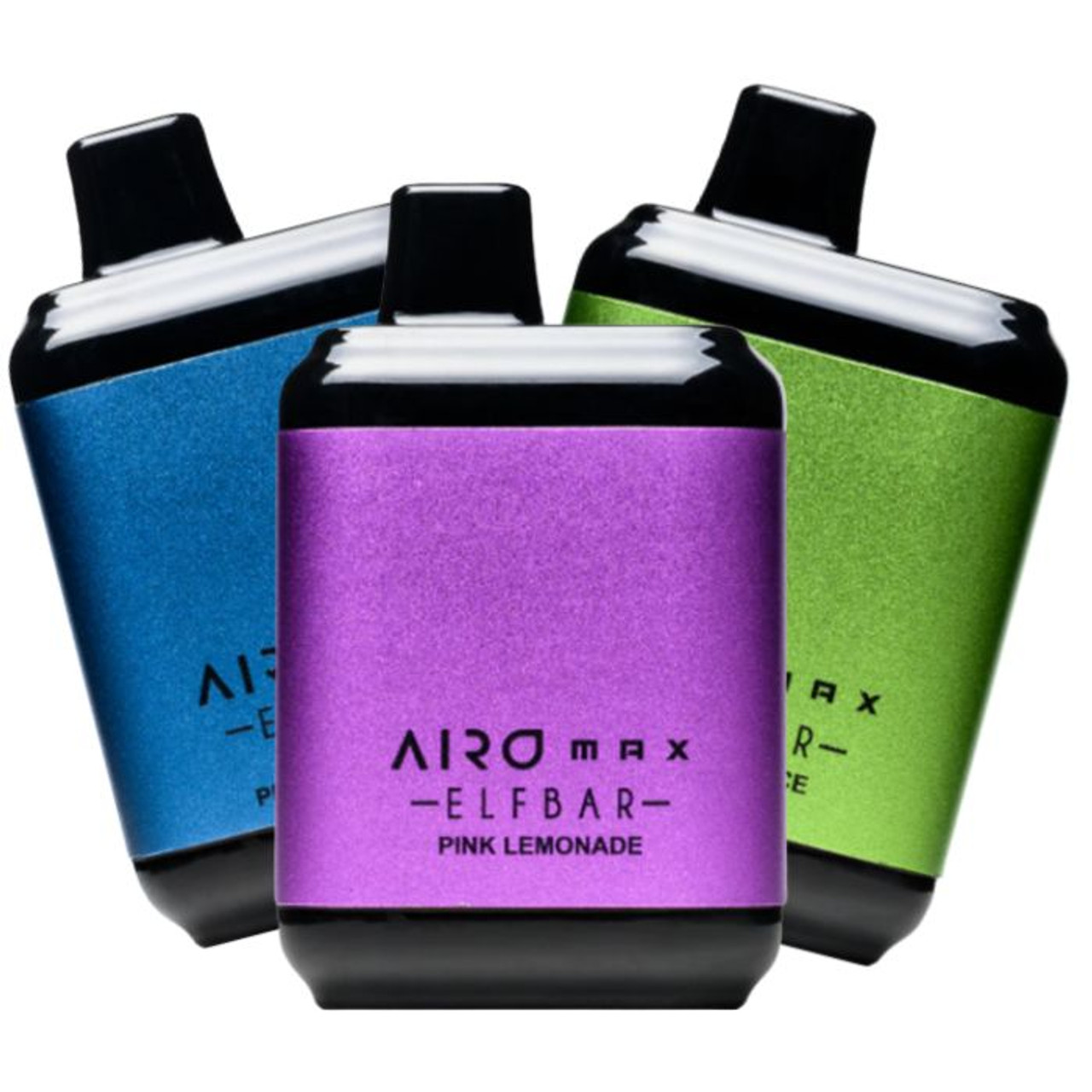

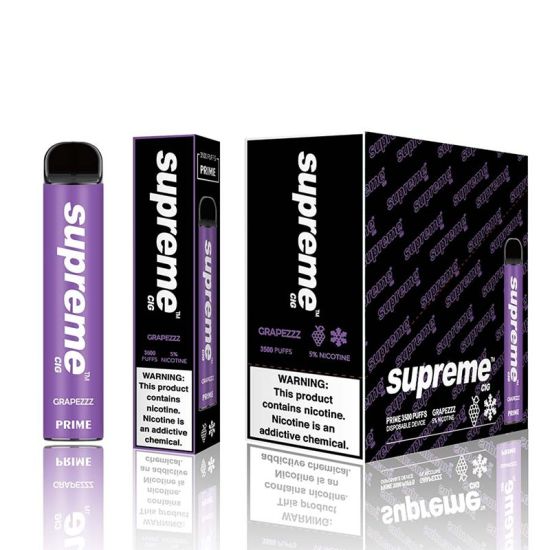

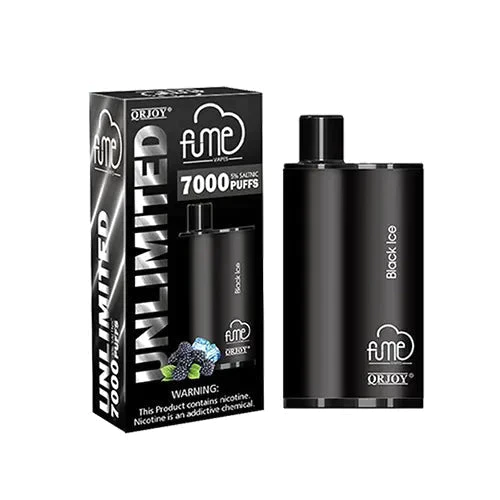

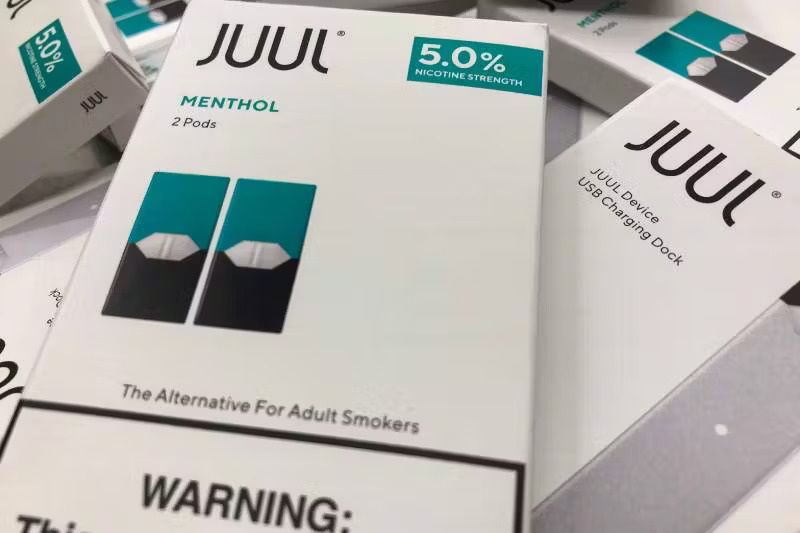

At present, Israel imposes one of the highest taxes on vaping products in the world. Vape liquids, devices, and related accessories are subject to a hefty tax, significantly increasing their retail prices. This taxation policy was initially introduced as a measure to discourage vaping, particularly among young people, and to address concerns about its potential health risks.

The Debate Over Effectiveness

The effectiveness of such an extreme vape tax has been a subject of debate. While proponents argue that it deters vaping and protects public health, opponents point out several challenges:

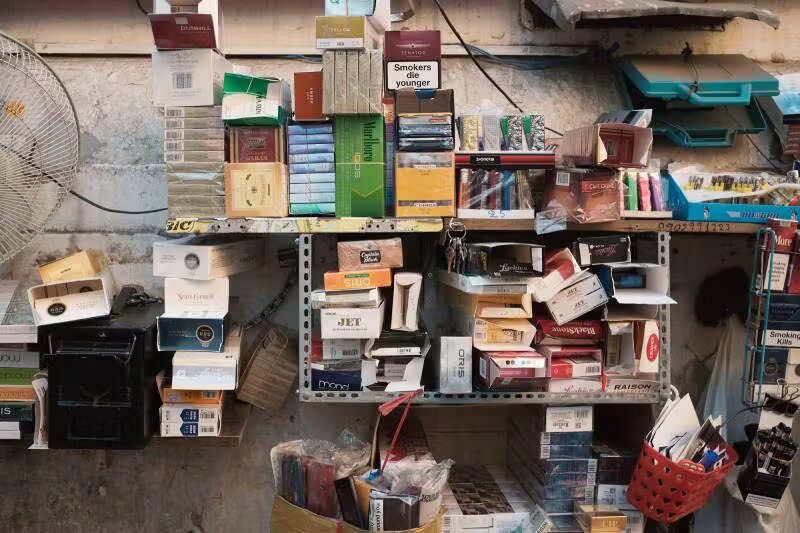

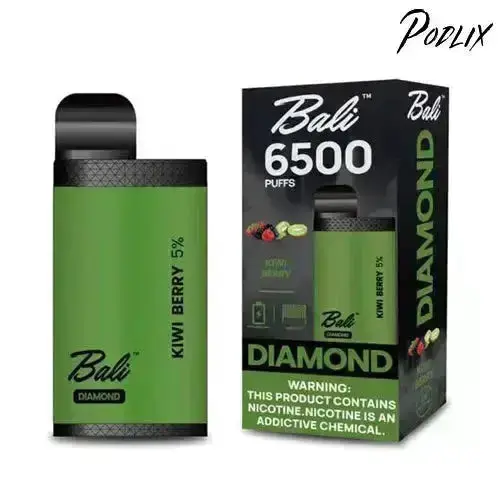

- Black Market Emergence: The high tax has led to the emergence of a thriving black market for vaping products, where unregulated and potentially unsafe products are sold. This undermines the government’s goal of regulating and ensuring product safety.

- Impact on Smokers: Some argue that the tax policy might discourage smokers from transitioning to vaping, which is considered by many experts to be a less harmful alternative to traditional smoking.

- Economic Implications: The vaping industry, including manufacturers, distributors, and retailers, has been hit hard by the extreme tax policy, leading to job losses and economic challenges.

The Upcoming Committee Decision

Evaluating the Impact

The committee tasked with reevaluating the vape tax policy will consider various factors. It will assess the impact of the current tax policy on vaping rates, the black market, and public health. This evaluation will be crucial in determining whether the extreme tax policy has achieved its intended goals.

Balancing Public Health and Economic Concerns

The decision is not solely about public health; it also involves balancing economic concerns. The committee will need to weigh the potential benefits of reduced vaping rates against the economic hardships faced and its employees.

Potential Outcomes

Maintaining the Status Quo

One possible outcome is that the committee may choose to maintain the current extreme vape tax policy. Advocates for this option argue that it is an effective way to discourage vaping, especially among youth. However, this decision may perpetuate the issues associated with the black market and negatively impact the vaping industry.

Adjusting the Taxation Approach

Another option is for the committee to propose adjustments to the taxation approach. This could involve revising tax rates, implementing stricter regulations on vaping products, or exploring alternative methods to achieve public health goals while mitigating economic repercussions.

Conclusion

The impending decision by the committee in Israel regarding the extreme vape tax policy carries significant weight. It will not only influence the trajectory of the vaping industry but also have implications for public health, the economy, and the balance between them. As the committee deliberates, it faces the challenging task of finding a solution that addresses the concerns of all stakeholders, ultimately aiming for a balanced approach that prioritizes both public health and economic stability. The outcome of this decision will be closely watched both within Israel and internationally, as it may set a precedent for how other countries address vaping taxation.

0